Sapphire Partners’ Beezer Clarkson — the rare limited partner brave enough to share her thoughts publicly — just joined my Substack Live to talk about her latest analysis of the state of venture capital.

You can listen to the recording in the video above. Clarkson published her findings on LinkedIn — and I’m including some of the key charts and takeaways below.

Clarkson asked whether megafunds are sucking up so much oxygen in venture capital that they aren’t leaving any room for smaller, boutique VC firms:

The traditional early-stage playbook is under pressure and I share the concern that replicating the venture returns of the past bull market looks increasingly hard (impossible?) to do.

The reality is more nuanced. The market is shifting, competition is fiercer than ever, and what I see is an evolution of venture.

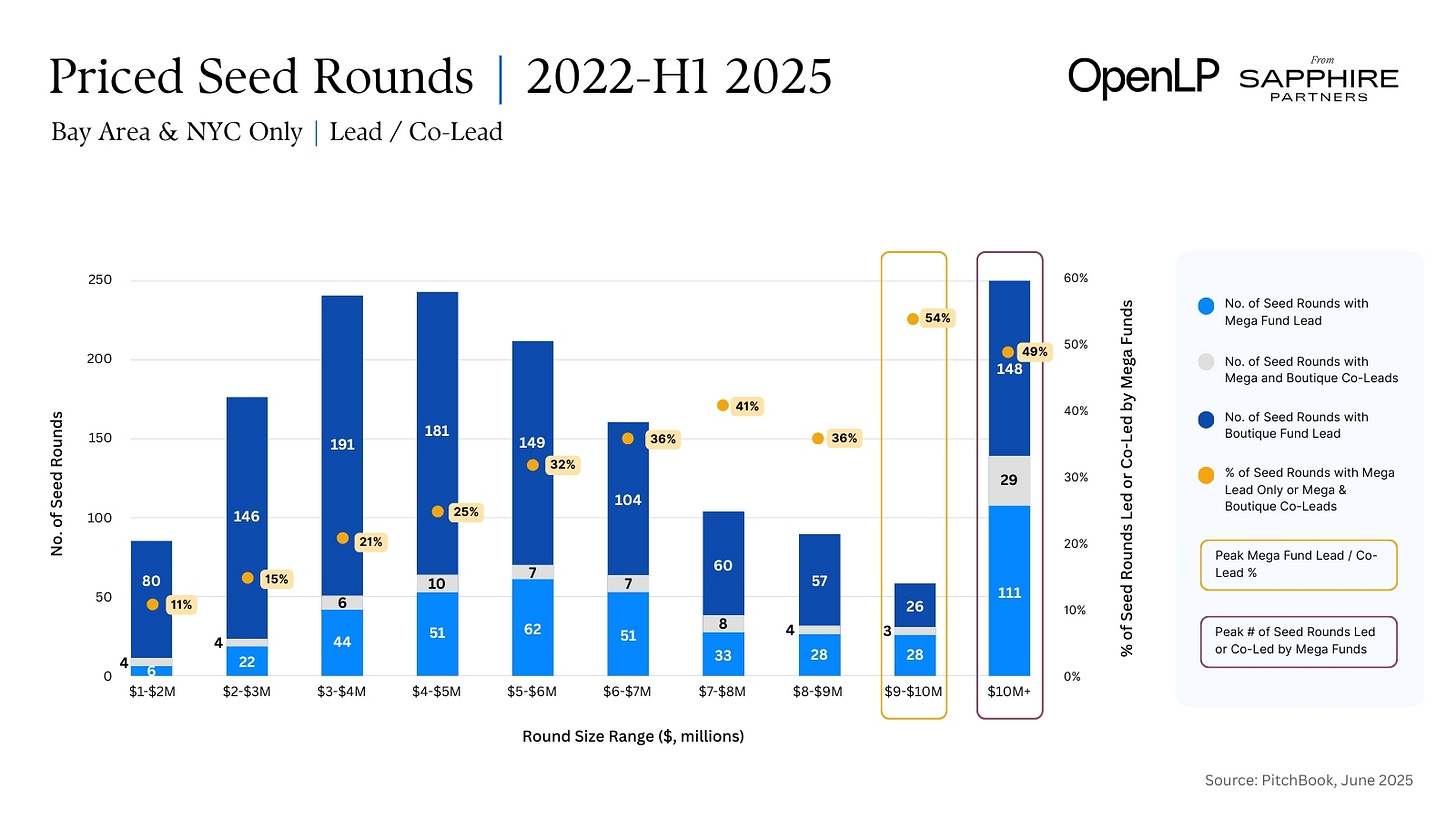

Thankfully, while megafunds loom large in priced seed rounds that raise $10 million or more, there seems to be plenty of room to go around among smaller deals. And even in larger deals, boutique firms still write a big chunk of lead checks.

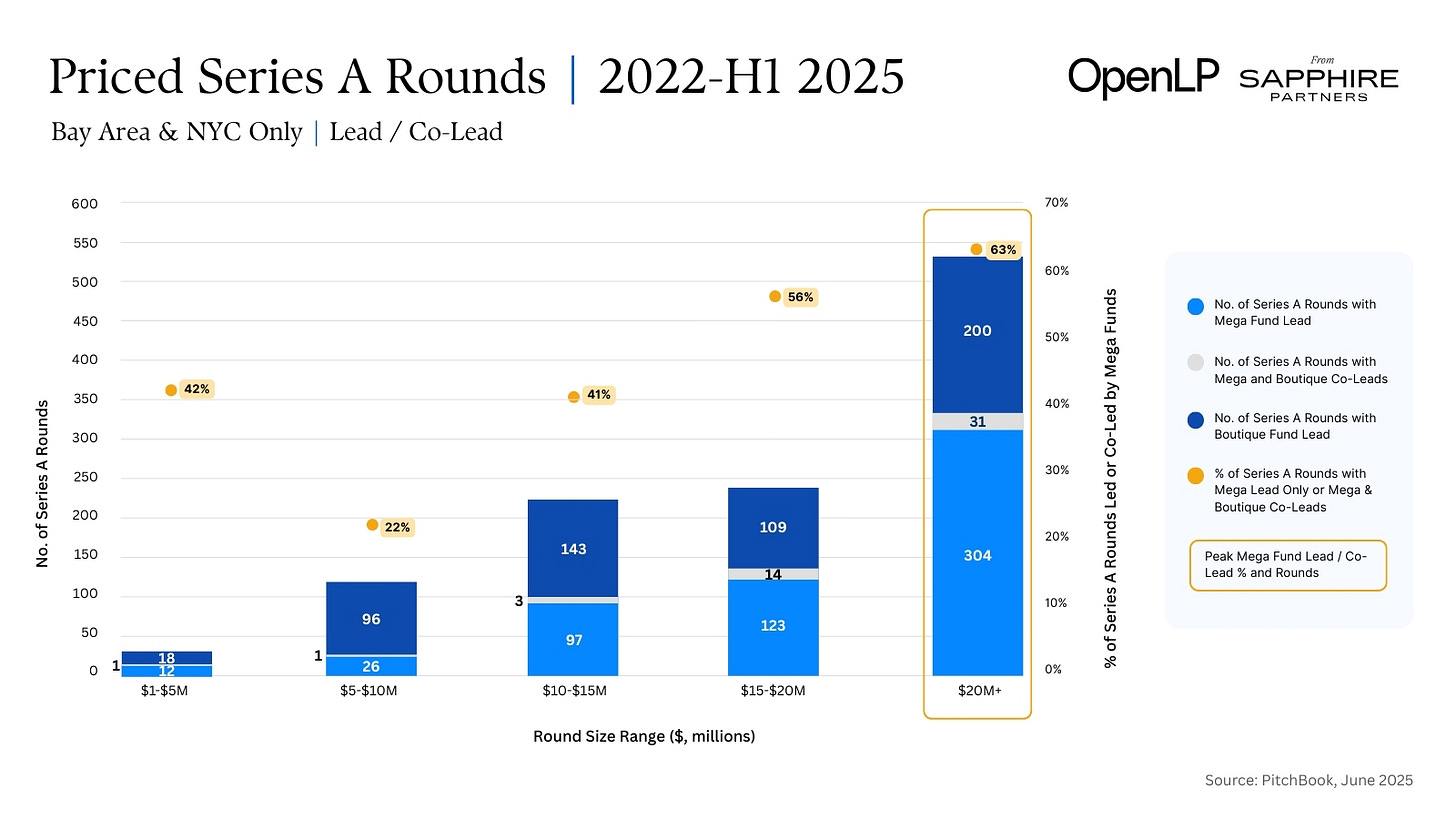

Similarly, with Series A rounds, megafunds gobble up the largest share of the largest deals.

Clarkson concludes in her piece,

No. I don’t think venture is broken.

I get why many GPs and LPs would think it is. The odds of replicating the bull market–level returns any time soon look slim from my standpoint. Mega-funds are showing up earlier, valuations—especially for hot seed and A rounds—are stretching, and LP capital is concentrating in fewer hands.

a16z Dominates Seed & Series A

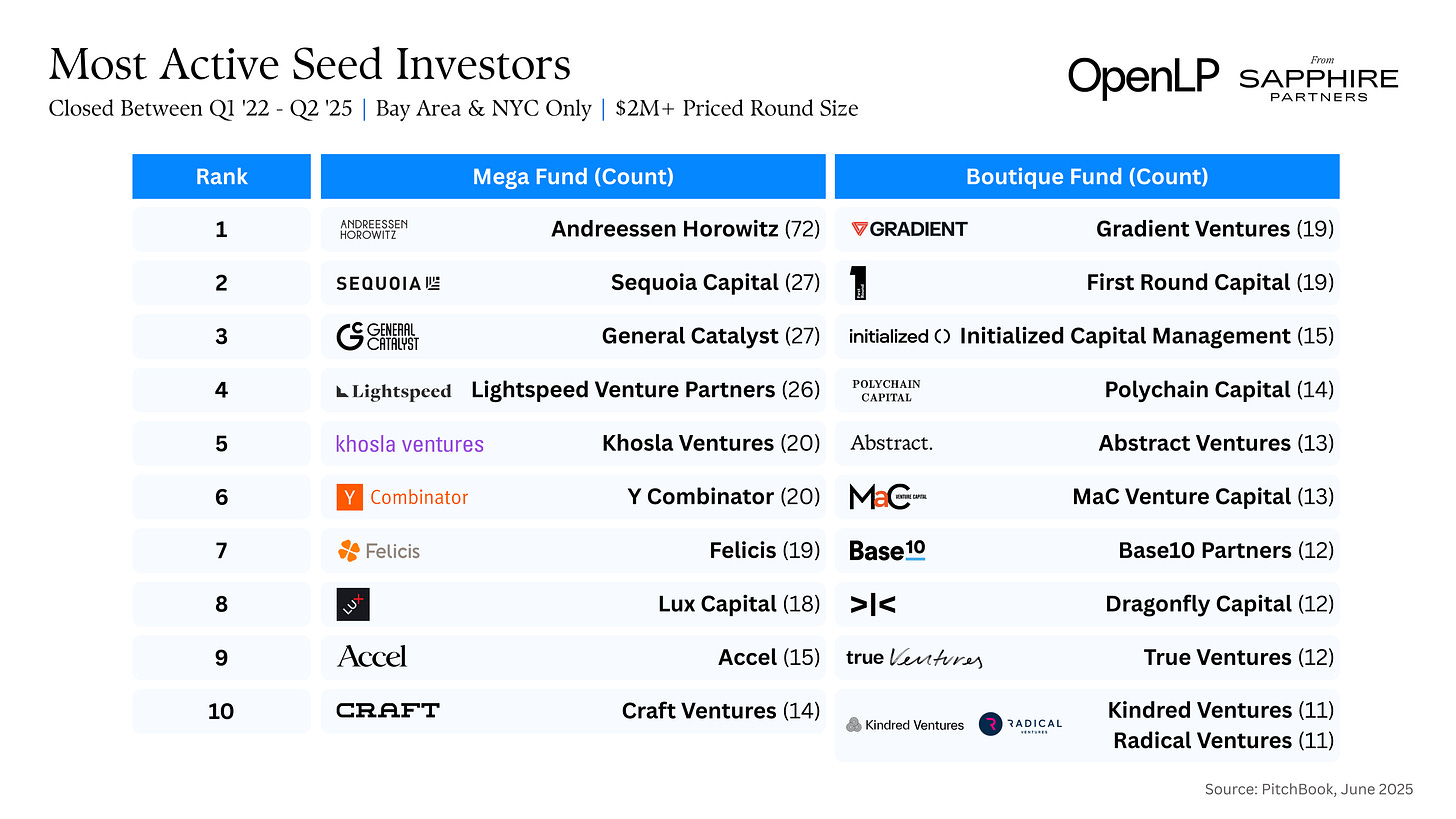

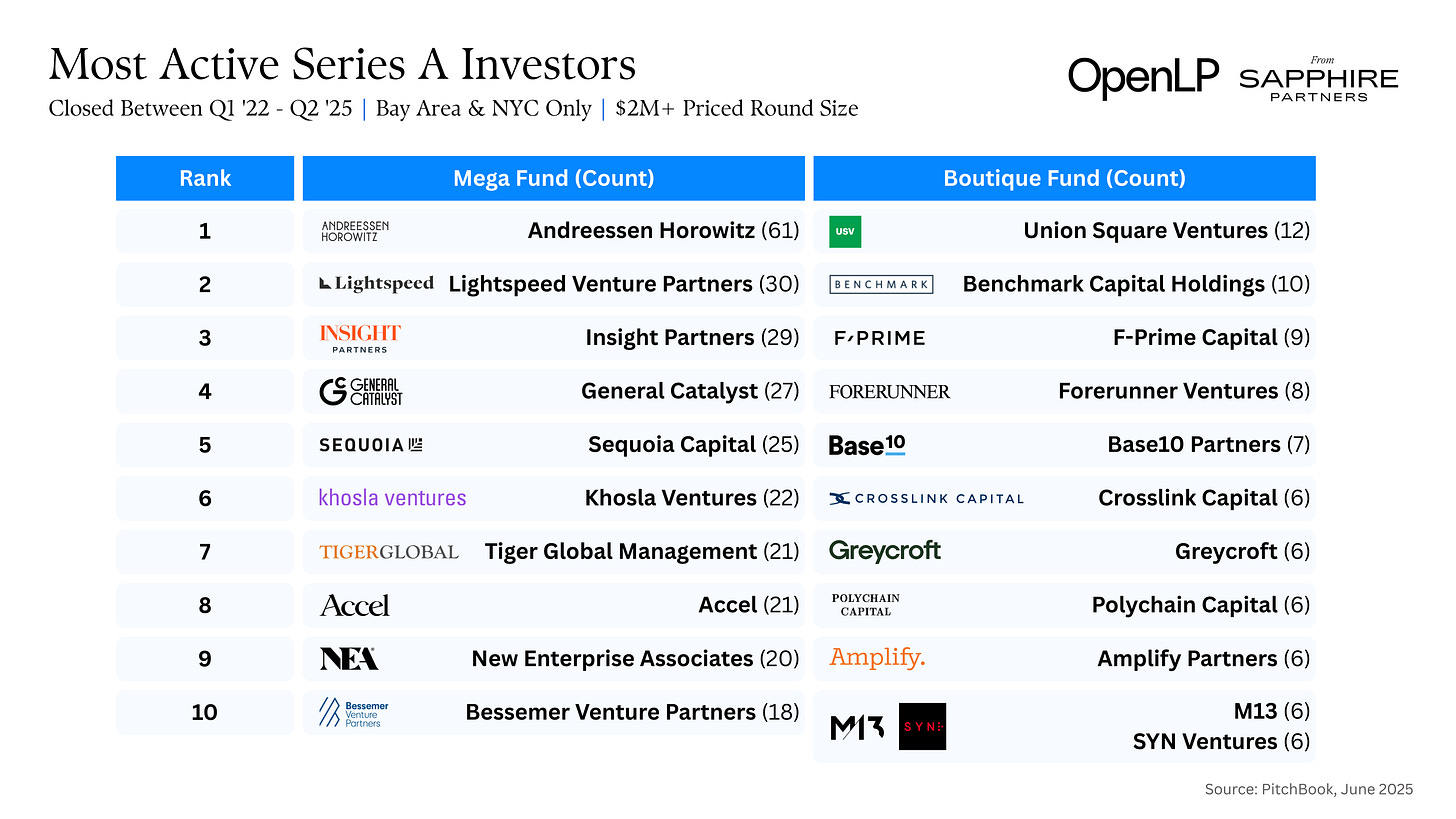

As part of the research effort, Clarkson also looked at which firms have been the most active in seed and Series A since the first quarter of 2022.

What stood out to me is just how active Andreessen Horowitz has been relative to the rest of the crowd.

On the Substack Live, we also discussed a16z general partner Martin Casado’s recent viral tweet: “The idea that non consensus investing is where the alpha is, is actually quite dangerous in the early stage. Follow on capital tends to be more and more consensus aligned.”

Give it a listen.