OpenAI's Sora 2 Heralds the AI Era for Social Media & the ‘Attention Economy'

Plus, Ex-Sequoia partner Matt Miller launches a London-based fund & Mira Murati's AI lab releases its first product

The Week in Short

OpenAI’s Sora 2 is the new social media star while Meta’s Vibes takes heat. Madeline & Tom talk bubbles with Alex Heath. New European funds buck fundraising slowdown. Cerebras & Rebellions fundraising shows appetite for chips. Periodic Labs shows that a16z & big VC still like science. CoreWeave flies high again as shutdown freezes IPOs. Mira Murati’s lab debuts an AI training API.

The Main Item

Video Apps Now, AGI Later as OpenAI Chases Revenue Opportunities

OpenAI again stole the tech show this week as its Sora 2 video generator flooded social media feeds with amusing and lifelike short-form content. Sam Altman’s deft touch in making his company the center of all the action is an ongoing master-class in viral marketing, as even the story you are reading can attest.

Mark Zuckerberg and Meta, whose somewhat similar social video product got a frosty reception, are surely a little envious. But we’re only at the beginning of a new battle for social media and the “attention economy,” and there was a lot happening this week.

OpenAI’s Sora 2 was released Tuesday and remains invite-only. It was another can-you-believe-this moment in AI, and the company now expects social media to be an important revenue stream. Filmmakers and actors can opt-out of the tool, but that won’t make copyright issues go away.

Underscoring its remarkable financial muscle, OpenAI cashed out some employees to the tune of $6.6 billion at a $500 billion valuation, Reuters reported.

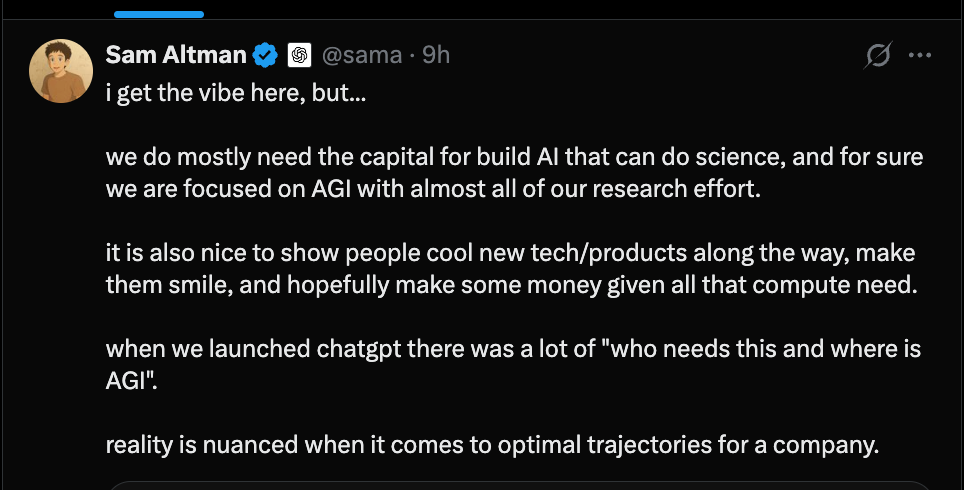

Sam Altman cast OpenAI’s push into social networking as a pragmatic near-term opportunity on the road to AGI, though some saw it as a bigger strategic shift. A top exec told us they didn’t want to put up too many safety guardrails that might make for a lesser user experience and hurt its ability to compete.

Meta’s Vibes, released last week, allows people to edit and remix the videos in their feeds with AI tools. But even as Sora 2 got a friendly welcome in most quarters, some of AI’s biggest boosters condemned Vibes almost immediately as a “slop factory.”

Sora 2 could of course end up as a slop factory too: remixing your own face into scenes with Sam Altman on Sora has the same novelty appeal as the rollout of DALL·E’s new image processor a few months ago — when everyone was Ghibli-fying themselves — and may not have staying power.

Even if Sora 2 soars, OpenAI still faces serious legal issues. As with ChatGPT, it’s moving ahead with a product it thinks people will like and worrying about fallout later— a time-tested and admired tradition in tech, to be sure, though hairier than ever with AI.

Sora’s content is tightly restricted to “PG-rated” material, but the tool considers copyrighted training data fair game. Media companies will have to explicitly opt out of becoming fodder for OpenAI’s image and video models — a preemptive strike against the lawsuits that are almost sure to come.

Permission vs. Forgiveness

Part of the reason OpenAI chose to ask for forgiveness versus permission is they wanted to ensure that they didn’t put too many guardrails in a new service that would have stymied people’s creativity, Varun Shetty, the head of media partnerships at OpenAI, told us in an interview.

But OpenAI also wants to get a leg up on other players in the space: “We’re also in a competitive landscape where we see other companies also allowing these same sorts of generations,” Shetty said. “We don’t want it to be at a competitive disadvantage.”

After experimenting with Sora’s social feed, we found the safety features surprisingly robust. Sora-generated content isn’t protected under Section 230, so OpenAI could be liable for what their models put out.

The system blocked attempts to generate a video of a person falling from a building, flagging it as potential “self-harm.” It also refused to render celebrities without an official account linked to their likeness. As a result, much of our feed consisted of Altman starring in increasingly surreal scenarios — from appearing on podcasts to sprinting through a simulated Grand Theft Auto city.

Google’s Veo 3 still leads the pack in visual fidelity, but Sora 2 delivers surprisingly photorealistic results and handles real-world physics better than any prior OpenAI model. Vibes, to its credit, produces animation on par with many professional studios.

Short-form video is a long way from the “machine god” that early AGI evangelists envisioned, but Sam Altman described Sora as an additional, subscription-based monetization play while the company continues deeper AI work.

OpenAI is betting that the social element can make Sora sticky. Longtime Newcomer readers may recall our story on YC and Sequoia-backed startup Can of Soup, which once let people generate playful AI portraits of themselves and their friends. The novelty faded quickly, but OpenAI benefits from an enormous existing user base to juice engagement.

According to Alex Heath over at Sources, for a subscription-service a bump in signups — even from memes or fads — can translate into long-term growth. The strategy is simple: hook users with novelty content, then retain them through deeper AI products and services. Mike Isaac and Eli Tan at the New York Times summed up the approach well, describing Sora as “the type of product that companies like Meta and X have sought to build: a way to bring AI to the masses that people can share, enticing one another to create posts and regularly use their apps and services.”

Top Investors Lap Up Latest Tender Offer

A successful push into social media could make a dent in OpenAI’s reported $2.5 billion annual cash burn; an additional subscription for social video and new in-app payments integrations with Shopify and Stripe show how this could play out.

The company also has seasoned leadership in monetization with the recent hiring of Fidji Simo, who was instrumental in building Meta’s $55 billion monumental ad business, as CEO of applications. How advertising fits into Altman’s plans isn’t yet clear, but it’s sure to come in some form.

Investors certainly seem happy with the strategy: Thrive Capital, SoftBank, Dragoneer Investment Group, Abu Dhabi’s MGX, and T. Rowe Price all reportedly bought shares in the recent employee tender offer that valued the company at $500 billion.

Meta’s Vibes has an even more direct route to monetization given the company’s massive distribution. With billions of daily users on Facebook, Instagram, and Threads, it can funnel audiences into Vibes almost instantly. The company has spent heavily poaching talent from OpenAI, DeepMind, xAI, and others, and presumably some of that brainpower is being directed to harvesting behavioral data for ad targeting.

There could be a cultural risk for the AI giants in leaning too hard into advertising though. Engineers motivated by the “grand vision” of AGI may bristle at spending their careers optimizing viral video feeds; Meta’s FAIR research leads have been unhappy with recent shake-ups and new rules around additional research reviews.

Shetty of OpenAI argued that the seeming frivolousness of Sora and its video feed belied how much it could advance the mission of AGI.

“If you think about video and this really interesting wedge into video as a way to think about virtual world building, then, yeah, it does actually sit really neatly, alongside or within the core mission,” Shetty said. “I don’t think it has to be an either/or.”

Newcomer Podcast

Are We Already Living Through the AI Bust?

Madeline and Tom are joined by Sources author Alex Heath to dig into some of the biggest questions in tech right now, like: Is the AI bubble about to burst?

OpenAI is propping up huge partners like Microsoft, Oracle, and Broadcom — but what happens if their momentum slows? Meanwhile, Meta just launched Vibes, a quirky new product that seems far removed from the company’s AGI ambitions.

One Big Chart

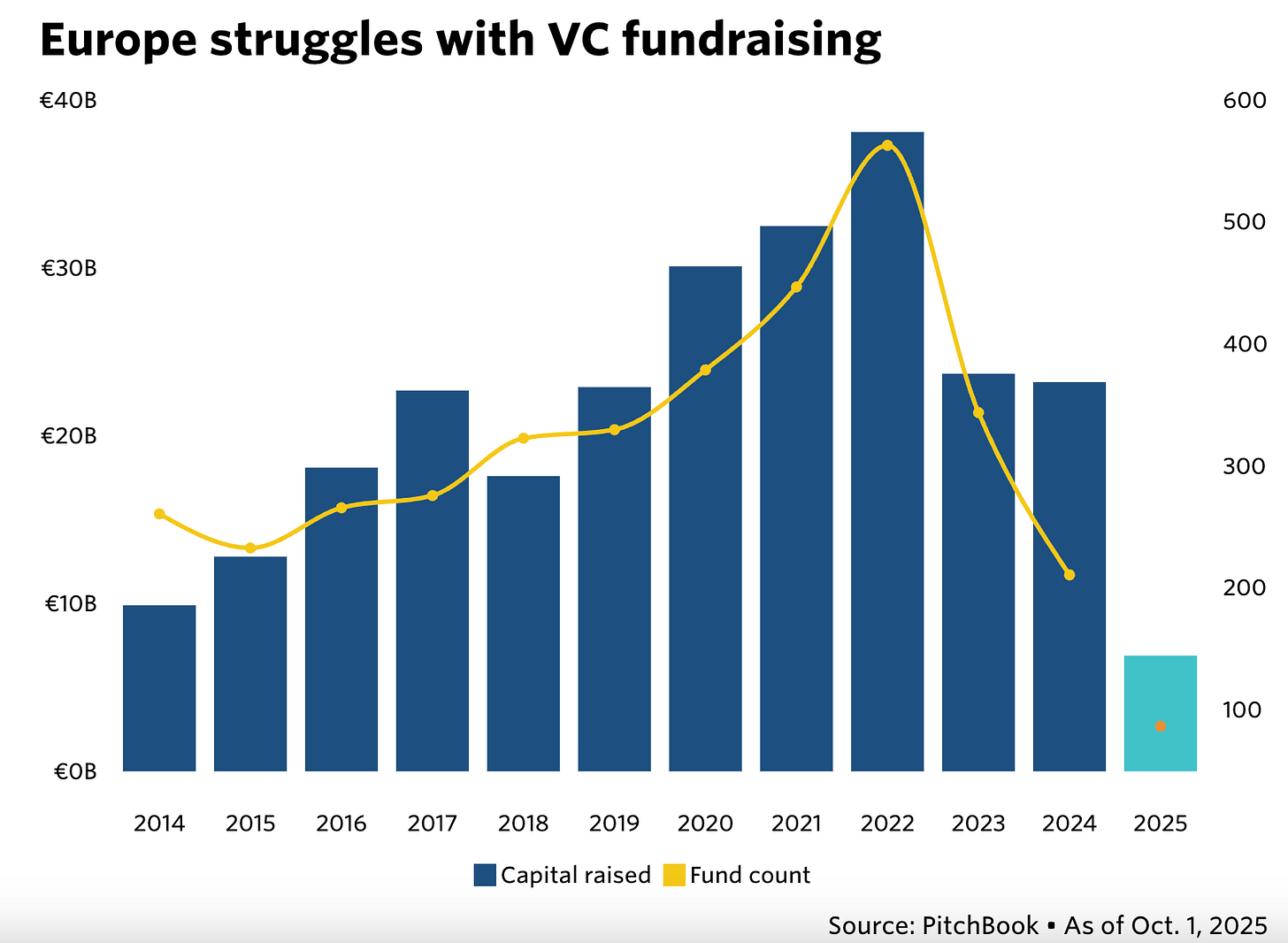

European VC Fundraising Stalls Despite Performance Edge. An Ex-Sequoia Partner Is Seizing the Moment.

European VC firms have slowed their money hunt in recent months, and fresh data from PitchBook indicates that 2025 has been the worst year for VC fundraising on the continent in over a decade. Paradoxically, the downturn comes even as European funds outperformed their U.S counterparts through the post-pandemic slump.

VCs in Europe have only taken in €6.9 billion so far this year, a drop of over €15 billion since last year. Yet European fund valuations didn’t fall as far or as hard as in the U.S. during 2022 and have recovered at roughly the same pace, according to PitchBook. That primarily reflects less exposure to late-stage deals.

Two new funds promise to test the strength of Europe’s early-stage ecosystem.

Former Sequoia partner Matt Miller on Monday launched London-based Evantic, a $400 million vehicle with a novel structure — the fund retains a host of tech industry “legends” who can advise startups on their growth journey, and in exchange receive both LP returns and up to half the carried interest on deals they nurture. Miller left Sequoia after a clash with former managing partner Michael Moritz over the fate of Klarna, which went public in September. Things are seemingly more smooth now, though — Sequoia is an LP in Evantic.

Across the Channel in Paris, early-stage firm Serena announced its fourth fund, a €200 million vehicle that will invest up to €15 million in startups, with a focus on applied AI and energy. Serena now has more than $1 billion under management.