Looking Back on the Week

Conversations with Benchmark's Eric Vishria and Figma CEO Dylan Field

Confluent Goes Public

Benchmark’s Eric Vishria has been singing the praises of Confluent to me for years and this week the “data in motion” company went public. So Vishria spoke to me over the phone from the periphery of what seemed to be a post-NASDAQ listing celebration.

Vishria invested in Confluent just one month after joining Benchmark. It was his first-ever venture check. “I got introduced to the founders. There was no company yet. They weren't even incorporated. It was three engineers coming out of LinkedIn.”

He remembers joining Benchmark on August 9, 2014, writing an email to the Benchmark partnership ten days later,1 and signing the term sheet on September 9 that same year.

“Literally the advice that new venture capitalists always get — especially back then — is just wait. Don't do a deal in your first couple weeks. Don't do a deal in your first six months,” Vishria told me. But Benchmark partner Matt Cohler helped convince him to follow his gut. Vishria remembers Cohler telling him: “We hired you for your instincts and you should trust your instincts.”

Vishria helped convince Confluent’s founders to raise a Series A directly, skipping the seed round.

Altogether, Benchmark invested $12.5 million in Confluent. According to the S-1, Benchmark owned 15.3% of the company before the IPO. The company’s market cap is somewhere around $15 billion. Benchmark’s stake is worth $1.6 billion today. That’s a 129X return in seven years.2

Vishria says he’s been poring through his old emails about the deal to figure out what he saw then to make sure he could replicate it. “They had a real vision for what we now call data in motion.”

Figma Raises from Durable at $10 Billion Valuation

It’s always a bit awkward asking CEOs if life is different after raising a bunch of money, especially when you scooped their funding round.

Figma CEO Dylan Field just closed a $200 million investment round led by Durable Capital Partners that valued Figma at $10 billion post-money.3 Raising a big chunk of money at an eye-popping price is never quite as transformational for these CEOs as one might think. “We’ve been kind of working on it for a bit now,” Field said before slipping into what must be the same kind of trance athletes enter when they give post-game interviews. “I’m just super, super thankful and grateful to have the opportunity to keep working towards the vision of Figma,” Field said. “And just an incredible team along with us. It's really, it's an amazing group of people.”

Right now, strategically, Figma is in an interesting place where it’s translating its design sensibility into tools for the masses while trying to make sure it brings hardcore designers along for the journey. The company is trying to expand the definition of who is a designer.

Its latest whiteboarding product called “FigJam” was built to let people collaborate remotely over a digital whiteboard. The tool was built with designers in mind but is relevant for lots of other people.

“Two-thirds of people that use Figma are not designers,” Field said. “My bet is that the audience of people that either call themselves designers today or want to be designers tomorrow grows a lot over this next decade.”

Then Field made a point that I think is worth sitting with and thinking about a little bit. This is a CEO that really has his pulse on where the work world is headed. Obviously he has a strong vested interest in this point of view but it sounds believable to me:

I think this is a decade of design. The same way the past decade was a decade of engineering and code, I think the value is going up the stack. It's not enough just to build something: you've got the cloud, you've got app stores. It's really easy to make something to use all the great developer tools that are available to get code out there. Now, you have to actually build it right and design it right. And we're seeing so many customers that are coming on that aren't even tech customers anymore. They're companies that are these large enterprise companies in spaces, you would be really surprised about, like, everything from finance, industrial, right? Where you'd be like, what are they designing? And it turns out that they're designing everything.

Toward the end of our conversation, Field mentioned that Figma’s latest fundraise included Base10’s Advancement Initiative — which I wrote about for paid subscribers earlier this week. “An employee was like, hey, I don't know if we're gonna fundraise again. But if we do, you should really talk to Base10. And I was like, oh, interesting. Yeah, feel free to introduce me. As we're closing the round.”

Field made room for the new fund.

Three Letters That Should Be on Your Mind: A.U.M.

That’s assets under management.

Andreessen Horowitz announced its third crypto fund. The firm raised $2.2 billion.4 We’re long past the point where the firm is making real money just from management fees — of course, it also spends more money than most other venture capital firms.

In November 2020, the firm said it had $16.5 billion in assets under management. If we assume the current number is at least that big, the firm is probably collecting more than $300 million in management fees a year.

Now, if you spend as much time talking to exorbitantly rich people as I do, you’ll hear this argument: the general partners at the firm are mostly already rich. They’re doing this for the carry — that multi-generational wealth — not whatever short-term wealth they’re making from management fees. That’s probably true for many partners. But still, Andreessen’s incentives are really drifting from many other venture capital firms: It needs to write a high volume of checks to deploy that capital and it’s generating a lot of revenue just for managing all that money.

This week the firm picked up David Haber, a former vice president at Goldman Sachs. He’s well-respected in the Fintech world.

Greylock: The Departed

I just find it perplexing that Greylock seems to have pushed John Lilly and Josh Elman toward the exits only for those two partners to end up having iconic portfolio companies. Lilly sits on the board of Figma. Elman led Greylock’s investment in Discord. Obviously it wasn’t as clear that those would be stellar companies when Lilly and Elman left the firm but that’s the nature of venture capital. The firm had two winners on their hands and let the partners who landed them get away.

Seven Seven Six

I spoke briefly with Alexis Ohanian since his new firm Seven Seven Six announced it had closed $150 million from limited partners.

I fished around as to why he’d left Initialized, the firm he co-founded with Garry Tan. Unsurprisingly, I didn’t get a very clear answer. He told me that “where I've had my best investments have often been the most contentious deals.”

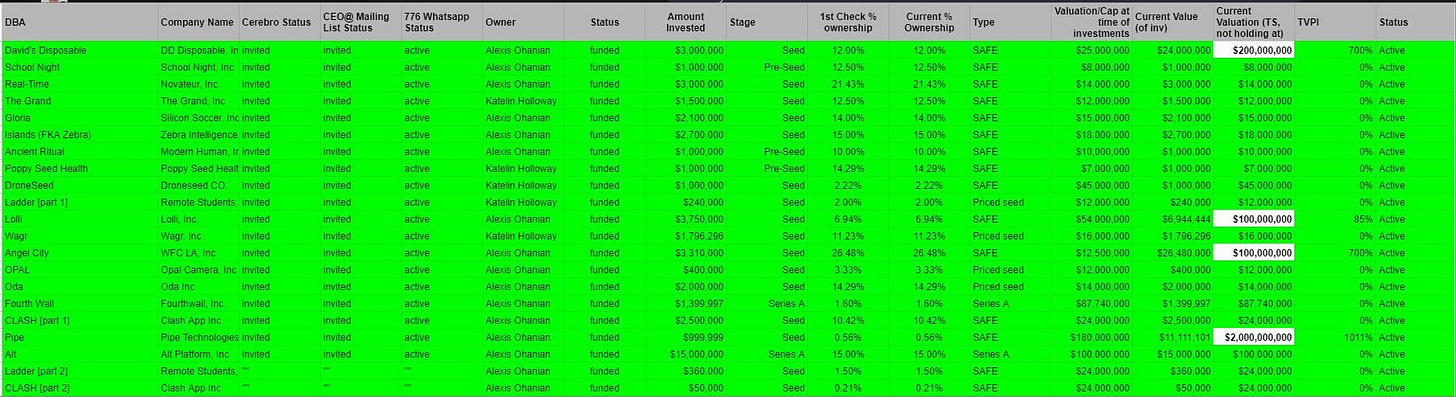

A source — who asked that I describe him as one of my most handsome readers — discovered that Seven Seven Six accidently posted a list of their deals as part of a job posting. This tipster grabbed a screenshot.5

Amazon PR

The tech media world is all talking about this story by Ali Breland about how much of a bully Amazon public relations can be. My limited interactions with Amazon support the thesis of this piece.

It’s not unusual for communications teams for corporations, non-profits, and the government all alike to be withholding in their interactions with the press and to try to spin things in the best possible light. It’s rarer that companies try to mislead and intimidate the press into falling into the lines that they want. But of the dozen journalists I spoke with for this story, most of whom declined to be identified out of concern for professional repercussions, all recalled times Amazon’s press team had engaged in manipulative and sometimes deceitful behavior. According to these writers and editors, and my own experience reporting on the company, Amazon’s comms team readily employs these rarer, bare-knuckle PR tactics. The ultimate result isn’t just that reporters have a harder time writing stories. Some may be deterred from writing on the company at all. And if those that do are deceived and unduly influenced, then by extension the public is as well.

Vishria sent me a portion of the email he wrote to the Benchmark partnership about Confluent on August 19, 2014, at 9:05p PT. Vishria wrote that he “walked away thinking we have to do this deal.” And he continued:

It is an open source (Apache) messaging bus developed at LinkedIn. The founders are the original founders of the project 4.5 years ago. LinkedIn, Netflix, Ebay, Pinterest, Twitter, Square, AirBnB, Bloomberg, and every startup is using it. We used it at Rockmelt and replaced all the old shit with it.

The big concern going in was what do they expand to beyond the message bus? Is this Tibco and all the mess that comes with that? Jay Kreps…laid out a really clear, well-thought out plan on how this becomes a real-time analog to Hadoop, and what the pieces around messaging that would be proprietary and enterprises would have to buy.

The thing I had underestimated going in — not only do they have 4 years of engineering work on the product, they have 4 years of understanding of the problem space, how to best apply and what to build around it to make it work.

They came in saying they were gong to raise a $2.5M seed round. I advised them extremely strongly to either raise $1.5 and raise again in 9 months or just go straight to the A. The extra million doesn’t do shit — just gives up their long term ownership. And frankly, I don’t see how this doesn’t go straight to A — there is too much momentum.

On Twitter, I gave Benchmark’s Bill Gurley a hard time about Confluent going public via an IPO instead of a direct listing.

Vishria said the company wanted to raise money when it went public and that the direct listing process doesn’t currently allow for fundraising. “We needed a capital raise,” Vishria, a Confluent board member, told me. “We were able to incorporate a lot of the concepts of a direct listing into this process.” The IPO didn’t include a greenshoe and it gave early employees more freedom to sell their shares than in many traditional IPOs.

I’d reported “roughly $9 billion” and that Durable would lead the round. The pre-money valuation was $9.8 billion. So I’ll count that as “roughly” correct. Inherently in reporting these funding rounds before they’re announced and as an independent reporter, I’m giving myself a little more wiggle room to report directionally correct information. I’m a little more willing to rely on second-hand sources than I was at Bloomberg. I’ll try to caveat my certainty appropriately and keep you updated as to where things land.