Sequoia's Unexpected Steward Shakeup

Plus, we have an answer to OpenAI's recent stumbles: show us the money.

The Week in Short

The lowdown on Sequoia’s decision to put Alfred Lin and Pat Grady in charge. OpenAI stirs the pot with talk of government guarantees. Ripple raises $500 million even as crypto stumbles. Beacon Software & Metropolis raise as AI roll-ups roll on. Mamdani’s win quiets critics, for now. Elon Musk gets his trillion-dollar Tesla incentive, designed to lure his attention back from xAI. Charles Schwab enters private-share arena with Forge Global acquisition, even as AI valuations wobble.

The Main Item

It makes a ton of sense that Pat Grady, 43, and Alfred Lin, 53, are running Sequoia Capital.

It’s just surprising that Roelof Botha’s run as Sequoia’s singular leader only lasted about three years.

If you’re building something ambitious, MongoDB for Startups helps you scale it. The program gives founders real resources to move faster and spend less. What you get:

Free MongoDB Atlas credits to power your product from day one

200M Voyage AI tokens to jumpstart AI development

1:1 guidance from MongoDB engineers for architecture and optimization

Partner and co-marketing support to grow visibility and reach

Apply to MongoDB for Startups →

This week, Grady, the growth investor who has leaned into AI, and Lin, known for his investment in DoorDash, his stewardship of Airbnb, and his ignominious bet on FTX, became Sequoia stewards — stepping into shoes once held by venture capital greats like Doug Leone, Michael Moritz, and Don Valentine.

Botha — the 52-year-old investor in YouTube, Unity, and MongoDB — will shift into an advisory role, keeping an office at Sequoia and holding Sequoia board seats. But he will no longer run tech’s most envied venture capital firm.

Sequoia Capital has said that the firm has distributed $52 billion1 since Botha first became the Sequoia steward for the US and Europe in 2017. Botha took over the firm when Leone stepped back in 2022 and bumped Botha up to senior steward.

During his three years at the helm, Botha established a perpetual capital vehicle for Sequoia and split the US-Europe arm from the firm’s China and India businesses amidst a rising tide of nationalism.

Sequoia Capital is good at keeping a secret. We don’t have the full story as to why Botha is out. But here’s what we know:

Ahead of the leadership switch-up, Botha appeared on a string of interviews, including All-In, Jack Altman’s show, and TechCrunch Disrupt. He called venture capital “return-free risk.” The interviews didn’t quite have the valedictory feel — instead it gave the appearance that Botha was still very much in the job. So on Tuesday, when Sequoia announced Grady and Lin’s ascension, it felt to many observers that Botha was being caught blindsided by the leadership change.

Following the announcement, the Wall Street Journal reported that Botha was “asked to step aside after some Sequoia partners raised concerns about his leadership style.” From everything I’ve been able to gather, it sounds like that’s right: the timetable for his departure was not set by Botha and that Sequoia’s partnership made the call, with Botha ultimately joining them in supporting the new leaders.

There are three leading theories on what went wrong: (1) Botha has a brusque management style that turned off colleagues. (2) Despite Sequoia being among the top investment firms in Silicon Valley, the firm could have leaned into AI harder and OpenAI in particular, much more aggressively.2 And (3) he let partner Shaun Maguire run wild on X, posting incendiary political takes that have shaped Sequoia’s brand.

I think it’s mostly number one and somewhat number two. As to three, I think the firm could use a new strategy around its political positioning3 but I don’t think that drove this decision. I don’t think it helped that Botha, like many managing partners at other venture firms, seemed to make worse investments once he took on the top job. (His predecessor, Leone, didn’t have the same problem.)

If you weren’t worried about bruising the ego of your leader, you would almost certainly rather have Grady and Lin running Sequoia right now. They’re in the prime of their careers, well-respected and well-liked, and leaning into artificial intelligence. And Sequoia, unlike most other venture firms, seems to have developed the knack for getting leadership transitions right.

Sequoia seems due for a return to dueling leaders — like in the Moritz-Leone days — where competing factions and perspectives bubble up and feel empowered to push their view of where technology is headed and where there’s money to be made.

Often venture capital firms wait too long to replace their leaders. This week, Sequoia stayed true to form, unsentimentally looking to the future.

— Eric

OpenAI Politics

OpenAI, Open Your Books

Tom has been following the dust-up over OpenAI floating the possibility of government help. He has some ideas.

OpenAI’s C-suite got into a pair of pile-ons this week, both related to questions around how the company is going to pay for its trillion-dollar-plus collection of data center contracts.

The first was when Sam Altman appeared on Brad Gerstner’s podcast. After Gerstner teed up a softball question on the data center contracts, Altman flippantly told the Altimeter Capital CEO that if Gerstner was so worried, OpenAI would be happy to find someone to buy out his shares. (Altimeter has invested hundreds of millions into OpenAI.)

The next dust-up came when OpenAI’s CFO Sarah Friar mentioned in an onstage interview at the WSJ Tech Live conference that she imagined the US government could play a role in their financing, potentially as a “backstop” for its loans.

In our outrage cycles built off clipped videos or quote fragments, sometimes viewing the whole context of the interview defangs the perceived insult. That’s not the case here. Friar tried to walk back her comments, but in the video she clearly suggests a government guarantee is one of many options the company would like to explore to help it raise money.

Such a backstop could drop the cost of financing and raise the amount of money it can raise on a piece of equity. This is a true statement!

In Altman’s case, maybe he was feeling his oats after a big couple of weeks of major deals with cloud operators and chip-makers, and getting the restructuring of the company across the line. But his dismissive response to Gerstner showed he was handwaving away a legitimate question. He said the company was well above a reported $13 billion revenue expectation for this year and has an aggressive growth trajectory.

Friar floating what would amount to a government subsidy for OpenAI understandably caused quite a stir, and prompted a statement from White House AI czar David Sacks that government would do no such backstopping. Altman, under pressure, then came clean with some numbers, posting on X the company was ending the year with $20 billion in annualized revenue and planned to reach “hundreds of billions” by 2030.

Altman insisted he was not asking for any kind of bailout. As far as transparency goes, it was a start.

The most irritating thing about the comments from Altman and Friar is that they showed OpenAI executives as elite string-pullers with special insight based on information not available to others. The fact that the public had to ask them to explain shows how ignorant we are of the grand plans of what’s arguably the most important company in the world.

OpenAI has always tried to have it both ways. On the one hand, it’s operating the “largest charity in the world,” developing life-saving technology that’s also critical to national defense, and is so important that the government might need to step in to make sure it all succeeds. On the other hand, it acts like any other top-shelf private company, and shows its annoyance when outsiders, i.e. journalists, the public, and apparently its own friendly investors, ask for even the bare minimum of information about how the business is doing, and question whether the company is, in effect, kiting its checks.

Here’s our proposal: OpenAI, show us your finances. Not just the revenue, as Altman did, but the margins, cash burn, and specific projections. If OpenAI wants to be viewed as so critical to the future of humanity, and the country, that it should have access to the public purse, then prove it.

Let’s not pretend this government backstop idea was an offhand comment. Documents from the company show they’ve been throwing the idea out there. AI proponents love referencing the 19th century railroad buildout as the antecedent to the current data center buildout. The transcontinental railroads were funded in large part by government debt and land grants. Why not here, right?

Frankly, the genre of business reporting where journalists scramble to get snapshots of the finances of privately-held companies, while the firms dodge and weave about the veracity of what we turn up, is a bad use of resources all around. It’s easy to forget that the secrecy is an arbitrary practice: in other countries, privately held companies disclose their finances regularly. So why not here?

Eventually OpenAI will go public so the mystery of its projections and its obligations will be revealed. But Friar indicated that day is still far off. Until then, we all have to feel around in the dark and get told by the masters of capital allocation that we’re not seeing the full picture.

Show us.

— Tom

One Big Chart

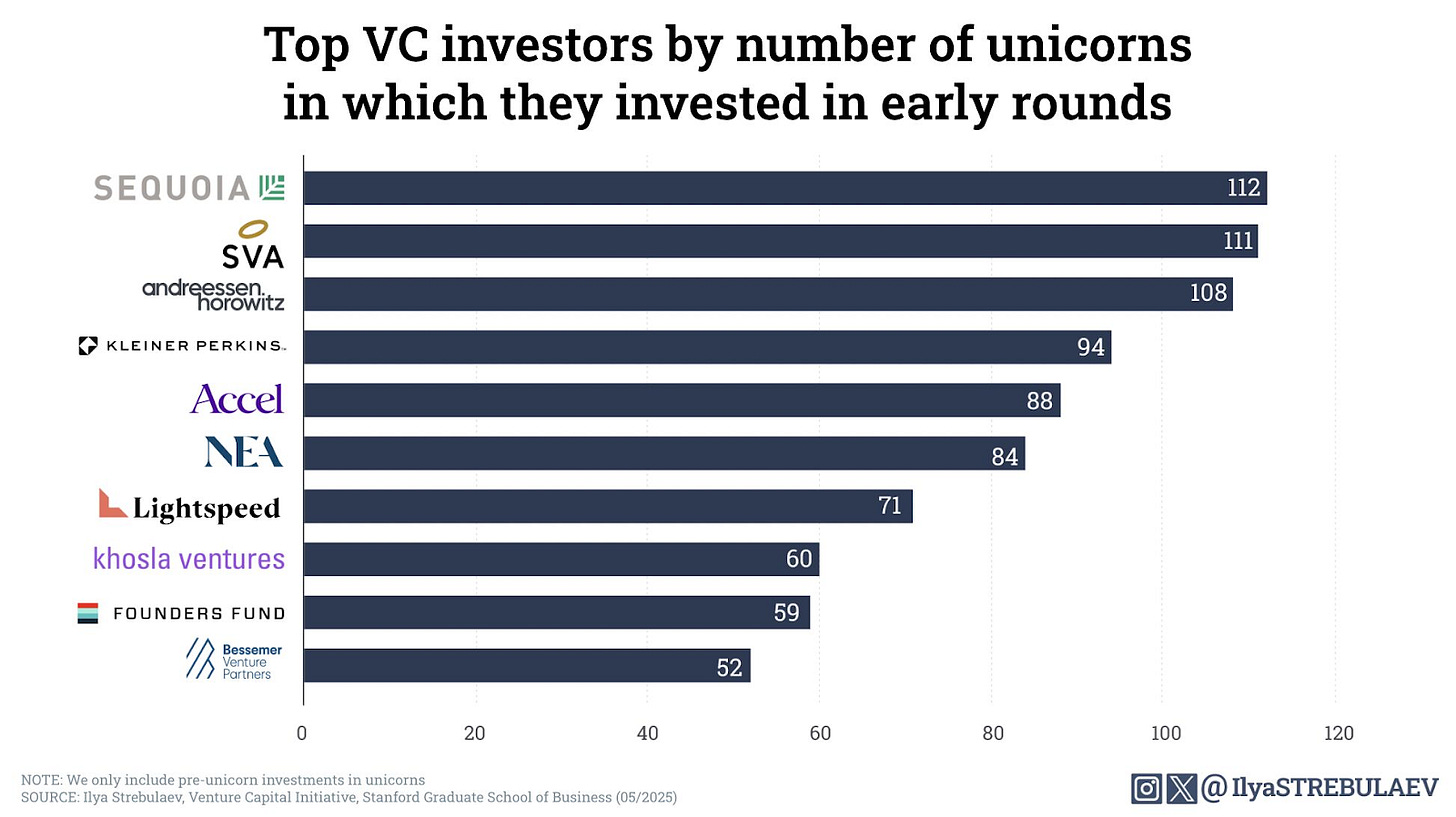

Sequoia Backed the Most Unicorns Early

Sequoia’s leadership change has left many wondering what the future holds. The glory of its past, though, speaks for itself.

The firm leads the VC industry for most US-based unicorn startups backed early (i.e. before they were already unicorns) from 1997 to 2024, with 112 investments that match the criteria, according to new data from Stanford’s Ilya Strebulaev. The list doesn’t contain too many surprises, though SVA at number two is certainly a vindication for Ron Conway.

Five Notable Deals

Metropolis, Ripple, Armis, Synchron, Beacon Software

Investors doubled down on the AI-fueled roll-up strategy, with the largest deal of the week including a big debt component to finance acquisitions.