Big VCs Raise Billions in Fresh Capital While Overall Industry Fundraising Sags

Plus, fear overtakes greed in the public markets as AI stocks stumble

The Week in Short

Lightspeed hauled in boatload of fresh capital for AI bets, as did Dragoneer. 2025 saw the fewest new VC funds in a decade, though megafunds boosted dollar figures. Databricks closed a rare Series L as it continues to delay an IPO. Vibe coding app Lovable gets $330 million. Meta’s revenue boosted by fraud. OpenAI chatter says the firm could raise $100 billion (that’s with a b). Also in b-words, Coreweave & Oracle take a beating on bubble fears.

The Main Item

Lightspeed Lands a Fresh $9 Billion as Gap Between Megafunds & Mid-Tier VCs Grows

Lightspeed’s announcement of a whopping $9 billion in new funds this week was a fitting finale to a year that underscored the growing divide between the haves and the have-nots in venture capital.

Lightspeed’s haul, spread across six new funds, is the biggest venture fundraise of 2025, and puts the firm among the handful of megafunds showing extraordinary strength even as much of the industry struggles. Crossover fund Dragoneer also raised a large $4.3 billion fund this week. These two capital raises alone would make up just under a third of what all VC fund managers raised in the first three quarters of the year, per PitchBook data.

Founders Fund also raised a $4.5 billion growth fund this year. Sequoia in October announced two new early-stage funds worth $950 million combined. A16z and General Catalyst closed $7 billion and $8 billion funds in 2024, respectfully, while Thrive Capital is targeting between $6 billion and $8 billion for its next fundraise, per an SEC filing.

Yet only 1,117 venture funds have closed globally in 2025, a huge drop from the nearly 2,100 funds that debuted last year. The ten largest venture funds collected 43% of the fundraising dollars, according to PitchBook data.

All this capital concentration is being fueled by — what else? — artificial intelligence. There has never been more of a consensus around the idea that a small handful of extraordinary and fast-growing AI startups represent the best chance for outsized returns in the coming years, even if they’re burning cash at an unprecedented rate.

“Now, the focus from LPs has been getting into these ‘white truffle’ assets,” said Samir Kaji, CEO of Allocate. “That has now increased the attention toward these megafunds, who have access to these ‘consensus’ hyper-scale AI companies.”

“It’s almost like the private version of the mag seven,” Kaji added.

Just read Harry Stebbings’ latest discourse-baiting tweet and the chatter around it to see who investors are clamoring for.

Two of Lightspeed’s new funds — the Co-Investment Fund and the unusual single-investor vehicle — are crafted to enable certain big-spending LPs getting a larger piece of the firm’s big AI bets. Lightspeed’s managing partners Bejul Somaia, Ravi Mhatre (pictured), and business lead Michael Romano told The New York Times that they traveled the world for this fundraise, landing new sources of capital from Australia, Japan, Korea, Scandinavia, and Mexico — all eager for more exposure for AI companies.

The different vehicles break down as follows:

Fund XV-A: a $980 million early-stage fund for backing startups at seed to Series A.

Fund XV-B: a $1.2 billion early- to-mid-stage fund for large Series A and some smaller Series B rounds.

Lightspeed Select VI: a $1.8 billion fund for getting large allocations in fast-growing “early-growth-stage” companies.

Lightspeed Opportunity Fund III: a $3.3 billion later-stage vehicle divided 50/50 between new growth investments and fresh funds for existing portfolio companies.

Lightspeed Co-Investment Fund I: A $600 million fund for specific LPs to co-invest alongside Lightspeed-managed deals.

A $1.25 billion single-investor vehicle for getting more allocation in specific deals. It’s a mystery who the investor is.

Unlike most venture funds, Lightspeed had a strong year for exits.

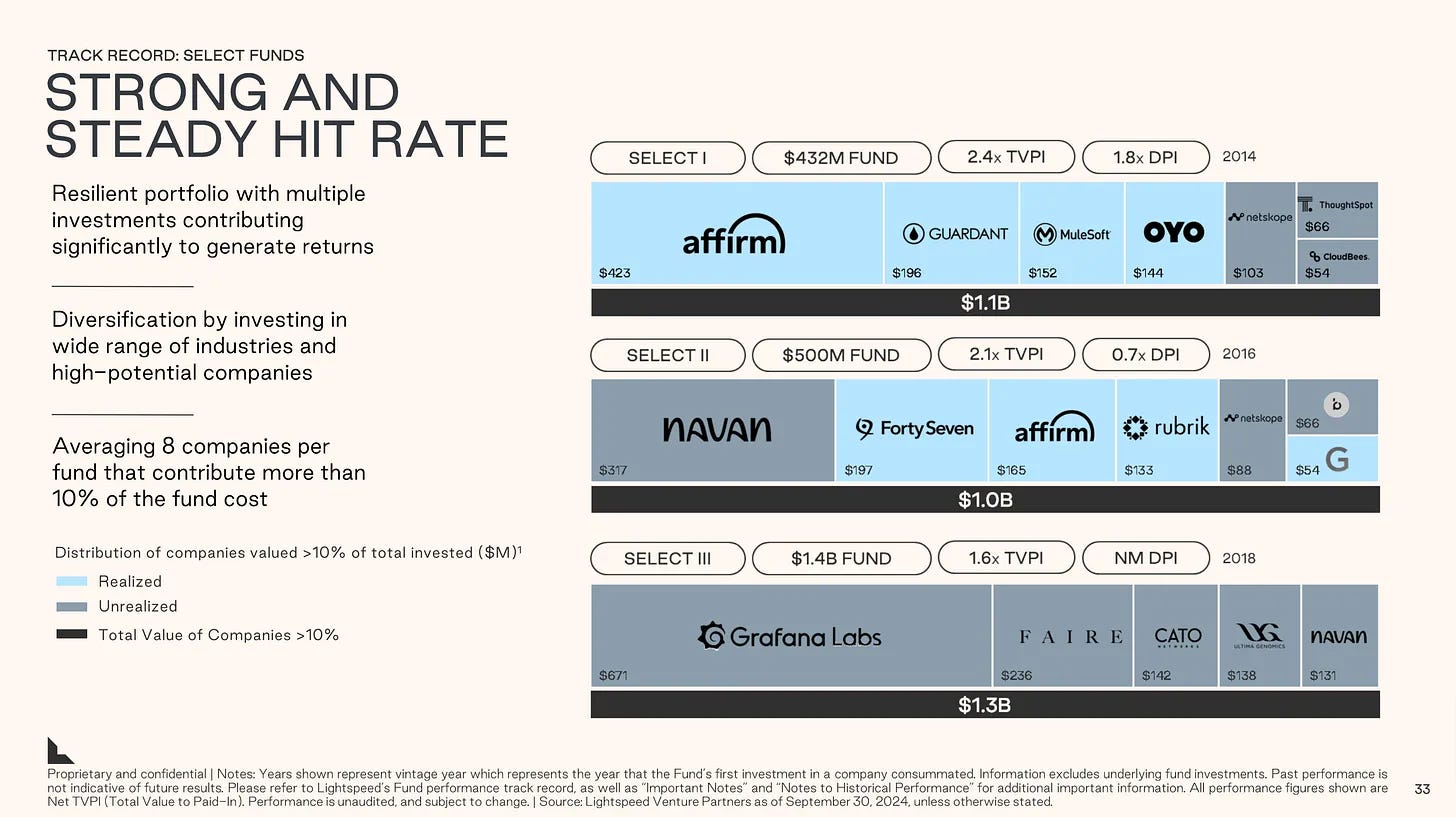

The firm may have gained much of its notoriety from former GP Jeremy Liew’s first check into Snapchat, but in 2024 and 2025 three of its bigger holdings — Netskope, Rubrik, and Navan — went public and yielded strong returns for the firm.

Lightspeed largely sat out the 2022 dealmaking, at least compared with other megafunds, but picked up the pace in 2023 and 2024 to become one of the most active of the large VCs.

When Newcomer published the fundraising deck for this new raise back in February, its enterprise and technical deals in Navan and Grafana Labs were front and center.

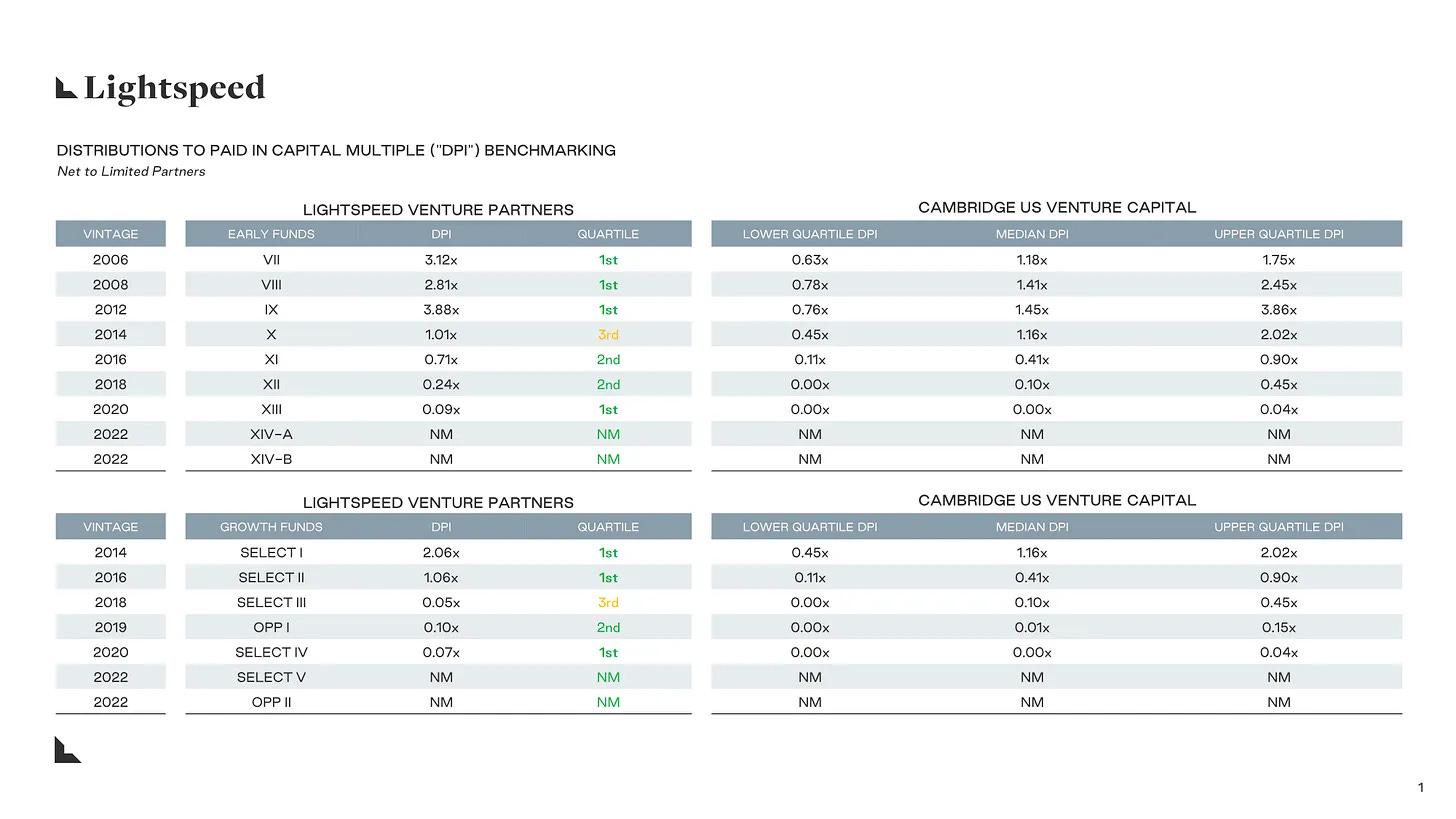

As we’ve seen with a16z, its earliest funds were top quartile when it came to distributions back to LPs, while its more recent funds — the ones where the size ballooned — have yet to prove themselves. Performance aside, big funds mean lots of management fees.

Lightspeed holds a sizable stake in Anthropic, first getting in the Series D round, and and is also a big backer of French AI champion Mistral, after leading its first major funding round in 2023.

Meanwhile, Dragoneer has put more than $3 billion into OpenAI — another example of a large firm pouring a lot of capital into one perceived AI winner. Run by founding managing partner Marc Stad, it’s part of a cohort of growth firms (Greenoaks and Glade Brook are also in this bucket) where a key iconic founder looks to make sense of the news upstream to pick later-stage winners.

This kind of capital concentration might make sense in the current moment. The jury is still out, however, on whether and when these big AI deals might yield cash returns.

One Big Chart

2025 Saw the Lowest Number Of New Venture Funds in the Last 10 Years

Gigantic raises by a handful of megafunds pushed venture fundraising numbers upwards in 2025, but it was still a very slow year for new fund closings.