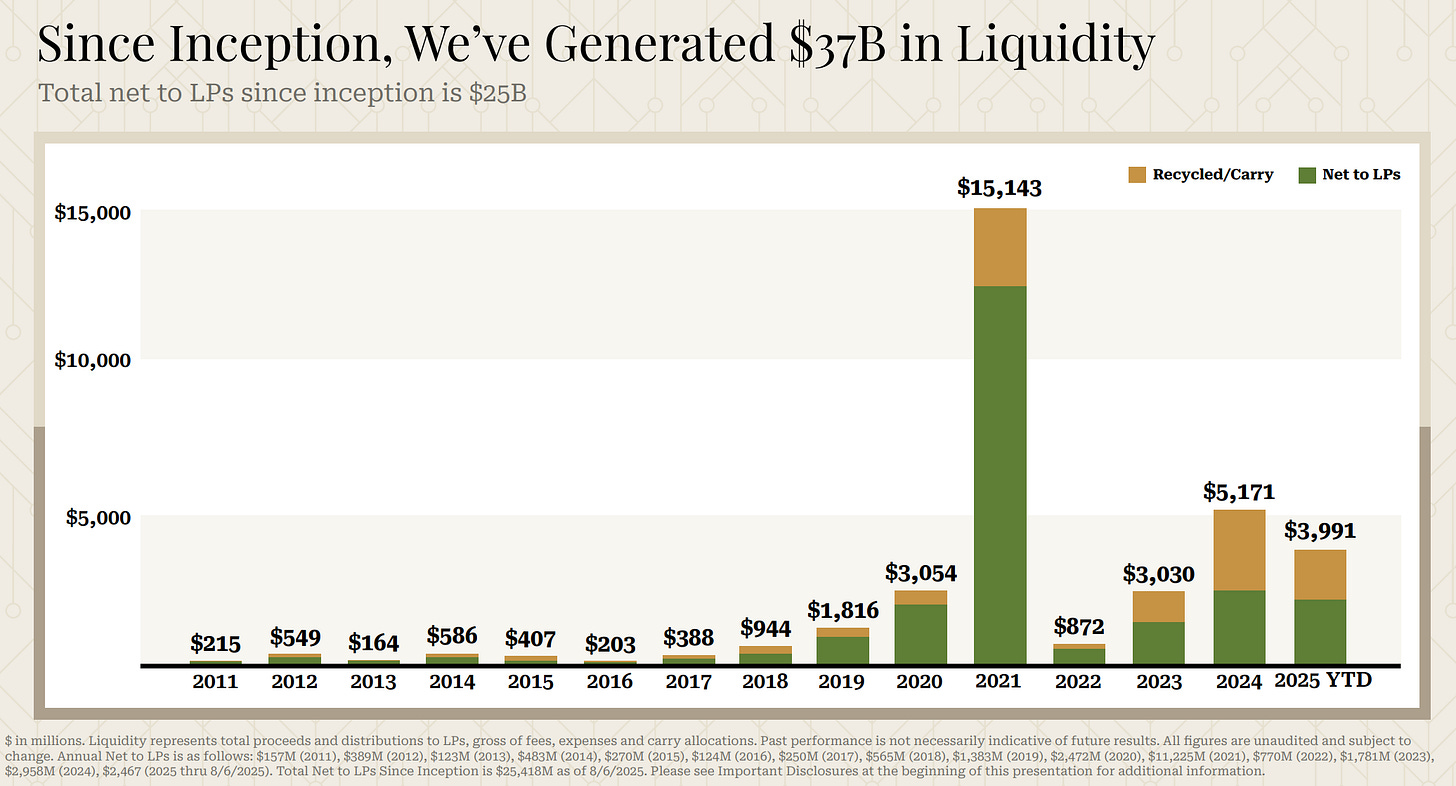

Andreessen Horowitz Has Returned at Least $25 Billion Net to Its Backers Since the Firm's Founding in 2009

The firm has held its $900 million 2012 Fund III at 9.4x net TVPI.

Andreessen Horowitz is perhaps the most powerful venture capital firm in the world with more investments in unicorn startups in the last decade than any other VC firm.

The firm, led by Marc Andreessen and Ben Horowitz, has been far more ambitious than a traditional venture capital fund. Andreessen Horowitz is backing defense tech giants, playing a key role in Trump’s TikTok deal, amassing shares in next-generation technology giants like Databricks, and pouring money into the current AI mania.

But despite the firm’s outsized influence, little is known about the fund’s performance and inner workings. It’s always been a bit of a mystery whether a16z’s capital bazooka strategy was merely a route to extreme relevance or one that would also secure them top tier venture capital returns.

I’ve got my hands on two (!) Andreessen Horowitz decks: one, which I can republish here because it doesn’t seem to have identifying markings, and an even juicier LP update from May 2025 that I’ll do my best to summarize for Newcomer subscribers.

I’ve got intel on which companies the firm sees as IPO candidates in its portfolio, the performance of many of a16z’s funds and how they’ve been marked over time, key leaders at the firm, and much more.