The 2026 IPO Boom Is Already Off to a Bad Start

Sources tell us Lambda is in talks to raise ahead of an expected 2026 IPO

The tech industry, much like the broader economy, is difficult to read right now.

On one hand, AI euphoria continues unabated with hundreds of billions of dollars pledged to startups whose combined valuations now stretch past one trillion.

On the other, public markets have been less forgiving. Over the past few months, many tech stocks have moved from drifting sideways to taking a beating outright.

The tension has made 2026 — once penciled in as a banner year for IPOs — look increasingly unfriendly to companies looking to exit onto the public markets. Companies can still squeeze through the IPO window, but most would be landing in a briar patch.

One sector that’s flashing warning signs is the AI cloud, or neocloud, sector.

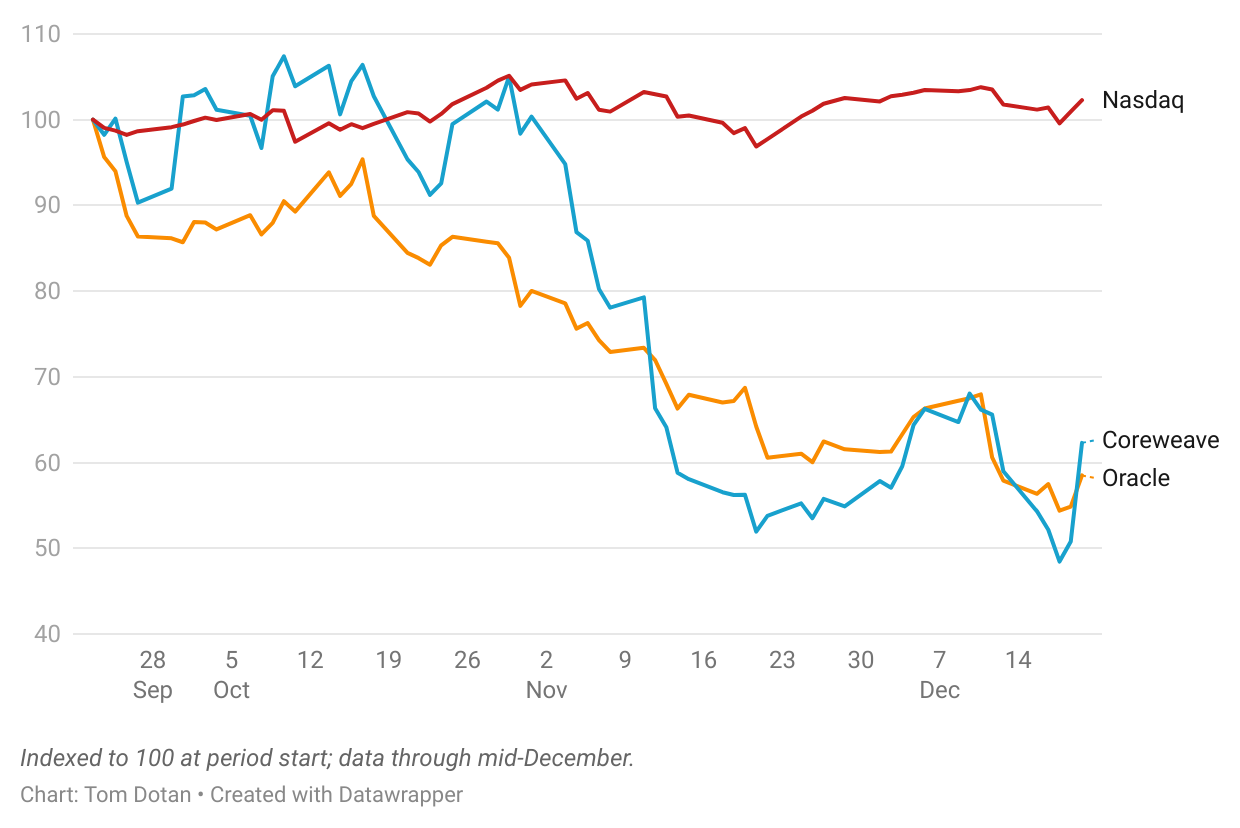

After a promising start to the year, public investors have turned on these stocks in a big way, worried about their mounting debt and missed deadlines for data center buildouts.

CoreWeave is down 50% in the last 6 months.

Oracle — which once posted a 36% one day gain after it announced hundreds of billions in forthcoming AI contracts (mostly from OpenAI) — has given all that back and then some. Oracle is down 4% in the last 6 months and 36% since mid October.

All of that is very bad news for the remaining private neoclouds who had hoped to go public next year.

Lambda, fresh off announcing a $1.5 billion Series E in November, is currently looking to raise another funding round, according to two people familiar with the matter. The company is seeking to bring in hundreds of millions of dollars in an unpriced mezzanine round that would convert into equity at a discount to its eventual IPO valuation, which is planned for next year, one of the people said. The Information previously reported that Lambda has hired bankers for an IPO in 2026. Lambda declined to comment through a spokeswoman.