Sunday Scaries & A Muted Monday: How VCs Are Navigating the Tariff-Driven Stock Market

VCs were counting on some serious public offerings this year.

If you were paying attention to the futures market or Asian stock exchanges Sunday, you’d be forgiven for expecting that we’d have another total stock market meltdown Monday over Trump’s unexpectedly sweeping tariffs.

Sunday, Y Combinator’s Garry Tan posted (and then pretty quickly deleted his post) that claimed “cascading margin calls seem to be forcing anyone with leverage to sell everything to cash right now.” Hedge fund manager Bill Ackman claimed (and then later retracted) that Trump’s Commerce Secretary “profits when our economy implodes.”

With all that fear, uncertainty, and doubt, a lot of us woke up pretty nervous Monday morning, worried that we could be heading further down the path to a truly unnecessary, self-inflicted recession.

Instead, on Monday, the stock market was basically flat. The S&P 500 closed down 0.23% — down 9.6% over the past 5 days and 13.7% so far this year. Meanwhile, Apple, which is highly dependent on international supply chains fell 3.7% on Monday — down 17.5% over the past 5 days and 25.6% so far this year.

It wasn’t nearly as brutal as Sunday had portended.

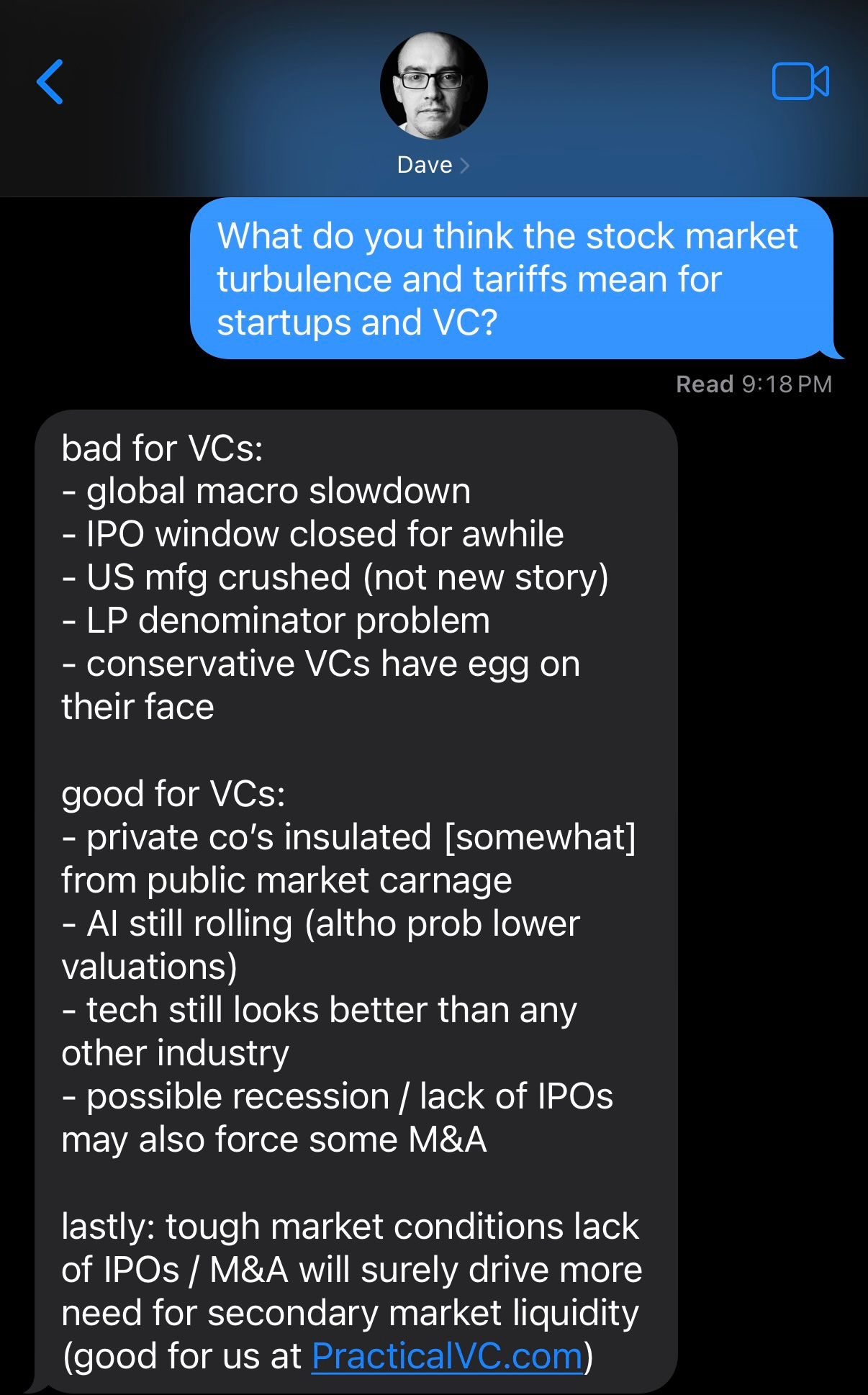

As the markets were waffling Monday, Newcomer spent the day talking to venture capitalists on what impact all the stock market turbulence and Trump’s tariffs would have on private tech startups and the venture capital firms that fund them. We talked and texted with Vinod Khosla, Keith Rabois, Kristina Shen, Mark Suster, Dave McClure, Rick Heitzmann, Mitchell Green, Nikhil Basu Trivedi, Roy Bahat, Logan Bartlett, and some investors we can’t mention.

Here Are a Couple of Key Takeaways

Uncertainty Is Going to Slow Down IPOs & VCs Already Owe Their LPs Some Cash

For venture capitalists counting on Klarna, StubHub, Chime, or any other number of potential tech IPOs, Trump’s tariffs drama has been an unfortunate stumbling block.

Yes, CoreWeave — which faced a rocky IPO that closed below its listing price on the first day of trading — is up 24.6%. That’s one positive sign.

But most companies don’t want to start publicly trading in a volatile market environment: they don’t want to get screwed by the whims of fate or an erratic new update from Trump on his tariff plans.

Many venture capital funds from the pandemic frenzy period were already behind in delivering actual returns (DPI) to their limited partners. This was supposed to be the year some public offerings would provide some much needed liquidity.

“LPs are already overexposed because the math has been out of wack for a while,” one senior investor told us. “The issue is that there’s no liquidity coming.”

If we don’t see the expected public offerings this year, things are only going to get worse.

It’s too soon to tell if market turmoil will force LPs to reallocate their funds into different asset classes, said FirstMark’s Rick Heitzmann, but if the market slump becomes more permanent, many will be facing a serious denominator problem.

“If 10% of your portfolio is private and your publics get cut in half and all of a sudden it's 20%, and if your target is 10% to 12%, you’ve got to figure out something else to do,” said Heitzmann. “Oftentimes that means not buying more privates, which means not investing in funds.”

Emerging managers will likely be hit the hardest from this LP pullback, Heitzmann said, since LPs would choose to prioritize investors that have made them money before. But for the foreseeable future, any fund or LP who is in need of liquidity in the short term is not going to get it.

Mitchell Green, founder and managing partner at Lead Edge, wrote a note to his limited partners Monday morning:

As it relates to our business, private equity and venture funds that sold and generated DPI look smart right now. As a lot of these unrealized gains disappear, DPI will be boss. It is also unlikely we will see the much-anticipated 2025 IPO rush. We are now talking 2026 at the earliest and that means LP distributions follow 6-12 months later, so we are talking 5 years (2022-26) with very low LP distributions. A lot of E&F’s and pensions are already overweight privates with still lots of unfunded commitments. These models are getting stretched. Throw on top of that the financial uncertainty and we believe our secondary/special situations team is going to be QUITE busy. If the market sell off continues this has the potential be a very target-rich environment for buying out LPs and GPs who are in desperate need of liquidity. It’s typically a good time to buy when others are forced to sell. It’s times like this where our creativity and price discipline should shine.

Startups Exist Outside the Fluctuations of the Market

The beauty of the private markets is that startups are insulated from the capriciousness of even the most powerful man on the planet.

“When we are making an investment today, we are not thinking about liquidity until the early 2030s — and who knows who is president by then,” Vinod Khosla told us.

Early stage venture capital firms have raised their funds, they’re going to deploy that capital, and startups are going to keep building. It’s mostly later stage startups that should really need to worry.

Roy Bahat, the head of Bloomberg Beta, said that he’d spoken to his portfolio companies’ founders and the single most important consequence of the tariffs so far has been that they’ve been a “huge distraction,” taking up air time during sales calls and interviews with job candidates.

Kristina Shen, a founder of the venture firm Chemistry, texted that some early stage startups could actually speed up their funding rounds but that later stage companies would feel a trickle down effect if public multiples stay depressed.

The market volatility means delayed IPOs, little to no liquidity, slowed software/AI spend which means slowed revenue growth. There will be a trickle down effect to the private markets. Growth stage valuations will get impacted first given private market valuations will be tied to public market valuation multiples. Early stage valuations will take longer to get impacted and we might even see a near term uptick in funding rounds as founders shore up capital to weather the storm.

If There’s an AI Bubble, Tariffs Won’t Be the Thing to Derail It

Repeatedly rising interest rates helped fell the dot-com bubble, so you wouldn’t be crazy to wonder if a tariff sell off could accidentally take some air out of AI mania.

Investors we spoke to seem skeptical.

Artificial intelligence is one answer to some of the challenges raised by Trump’s tariffs (though not necessarily the answer Trump or American workers want). Artificial intelligence could make it easier to replace expensive American workers with robots and software, meaning that even if we bring work back to America, we won’t necessarily be bringing back those same human jobs.

“Robotics just became more interesting as a whole sector,” Nikhil Basu Trivedi, a founder of the venture capital firm Footwork told us. “I think the problem with this action is it’s delusional that American manufacturing is going to come back and somehow jobs are going to come back in those fields. What’s likely is the opposite — we figure out how to do more with less labor.”