Software Stock Swoon Signals Extraordinary Faith in AI

Plus, Anthropic's Super Bowl ads get under Sam Altman's skin

The Week in Short

Figma becomes a poster child for the SaaS slide, though Blue Owl says all’s well with software. Amodei provokes Altman with Super Bowl ads. New study supports strength of scaling laws. Waymo, Cerebras & ElevenLabs raise funds, along with a foundation model for smell. Musk Inc. merger & prospective IPO to test the faithful. Brutal Washington Post layoffs bring harsh words for Jeff Bezos. Michael Saylor & the Winklevoss twins among the early victims of Bitcoin rout.

The Main Item

SaaS & Crypto Meltdowns Hit VC Gains, But Software Isn’t Dead Yet

The abrupt meltdown in SaaS stocks that sent the shares of companies ranging from Salesforce to Adobe to Thomson Reuters tumbling has erased an astonishing $1 trillion in market cap in just seven days. The much-anticipated AI-ification of corporate America, investors are realizing, will come at someone’s expense — and software companies are first in line.

There’s nothing novel about a new generation of technologies disrupting and ultimately displacing its predecessor, and of course that’s how venture investors make their money. In this case, though, there are likely quite a few who wish it hadn’t happened quite so fast.

The SaaS sell-off — which began towards the end of last year and took a sharp leg downward this week with a new Anthropic product announcement — likely shows a little too much faith in AI companies’ ability to quickly displace enterprise software and services. Companies with a sturdy customer base and a profitable history are likely to have staying power, and any detours on the road to AI could quickly bring investors back their way.

Marc Lipschultz, co-CEO of Blue Owl Capital, a big lender to software companies that faces many pressures of its own, insisted on a Thursday call with investors that its software loan book was “pristine.”

Still, even if there isn’t an enduring valuation reset across the sector, it’s been a sobering stretch for software investors. VCs are already sitting on a lot of software unicorns that are underwater from their 2021 valuations, and the IPO revival of the past year has proven a mixed bag.

Last July, for example, Index Ventures, Greylock, Kleiner Perkins, and Sequoia were all celebrating their massive score with Figma, whose shares closed at $115 on IPO day, more than triple the offering price. Figma was supposed to disrupt Adobe, which tried to buy it for $20 billion but was blocked on antitrust grounds.

Figma raised $1.2 billion in the IPO, and the venture investors, after cashing out small amounts, were left holding shares worth $24 billion in a company with a market cap of $68 billion. But the stock has been on the downhill ever since, and after fresh recent declines sits at $22, for a market cap of less than $11 billion.

It’s unclear how many shares the VCs may have sold or at what price after their lockups expired, but it’s safe to say the SaaS dive has cost them many billions.

Travel software and services vendor Navan, which went public last year, was another victim of the souring sentiment. It saw its shares sink 20% in their first day of trading from the $25 offering price, and they now sit at $10. Certainly any new SaaS IPOs will face stiff headwinds; it’s hard to see often-mooted IPO candidate Canva, for example, taking a swing given the recent fate of Figma and Adobe.

The crypto rout is also causing some heartburn on Sand Hill Road. Stablecoin darling Circle, which went public last June, is still trading above its IPO offering price — but at about $50 it’s down by half from its first day close and far below its $240 peak. Crypto continues to trade as a category that tracks the price of Bitcoin, more or less; Coinbase is off 41% in the past month.

All of this only underscores the stakes in the manic AI race. If you think of the flight of money from SaaS as corresponding to the flood of money into AI, it looks like a somewhat logical rotation of capital. But even if the more ambitious projections about AI prove correct, it’s unclear whether the industry will ever carry the margins of the SaaS businesses that have underpinned Silicon Valley for so long.

As Elon Musk demonstrated very well this week with his merger of xAI and SpaceX, investing in AI has become a game of blind faith even more than its predecessor industries (at least if we leave crypto aside). SaaS businesses, even at an early stage, traditionally have a straightforward and margin-rich revenue model, a relatively predictable expense structure, and a well-defined target market. A lot of AI companies valued in the many billions — or in the case of Musk’s xAI, $250 billion — have none of those things. YOLO.

It’s not hard to imagine this cold reality moving the sentiment on software and data companies in the other direction at some point. Thomson Reuters isn’t going to surrender Westlaw’s position in every law firm in America without a drawn-out fight, and has AI tools of its own. Marc Benioff (pictured) is frantically pivoting Salesforce to an AI-first strategy and is likely to have at least some successes. The same goes for Adobe and ServiceNow, another SaaS giant that’s taken a big hit.

As Microsoft above all has shown, it’s possible to keep a grip on corporate customers from one generation of tech to the next. It’s the AI companies that still have to prove they have the products for the long haul.

Super Bowl Ads

A Super-Diss of OpenAI’s Advertising Embrace Brings Barbs From Altman

Anthropic’s impressively direct assault on OpenAI’s new advertising strategy, debuting with two spicy ads during this Sunday’s Super Bowl, clearly hit a nerve with Sam Altman. He attacked Anthropic in a blog post Thursday as “dishonest,” “deceptive,” and “authoritarian,” and defended OpenAI as the company “committed to free access,” and to the ethic of the “builder.”

There’s a highly personal dimension to the vitriol, of course. Anthropic CEO Dario Amodei and his co-founders left OpenAI because they didn’t believe in Altman, and now they’re rapidly closing the gap with their erstwhile boss on revenues and valuation in part by positioning as the responsible actor in a dangerous field full of cowboys. If you’re Altman, that has to sting.

Beyond that, though, the intensifying Altman-Amodei feud underscores the enormous stakes riding on unanswered questions about AI business models. Of all the big-tech investments in AI, it’s notable that only Meta’s seems to be yielding a clear revenue bump in the short term; AI is very good at creating and targeting advertisements.

The money-making potential of ads integrated into AI chats is obvious, though mostly depressing to contemplate. Hopefully Altman’s promised OpenAI Super Bowl ad will be more uplifting.

One Big Chart

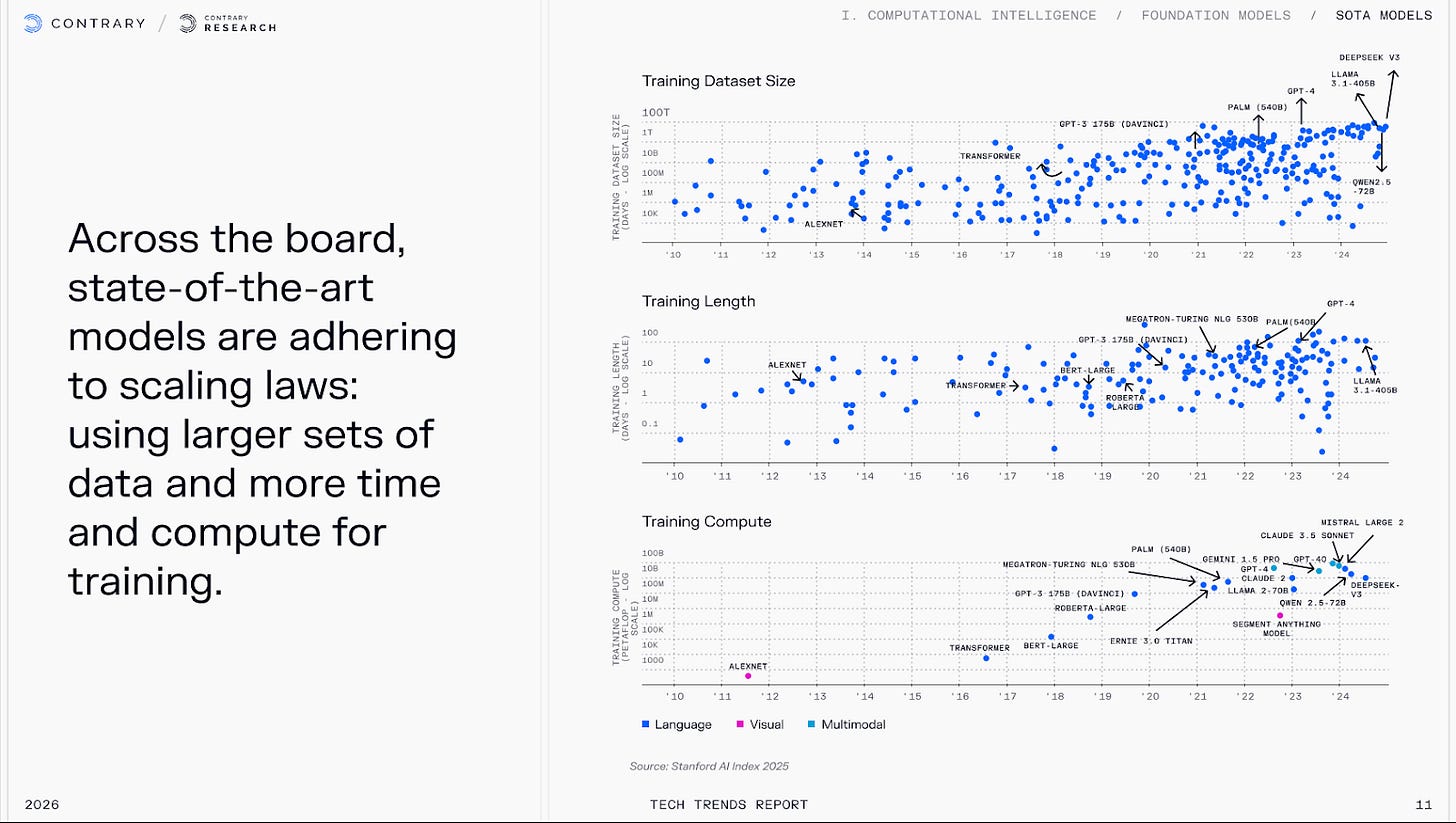

Scaling Laws Are Holding For the Top AI Models

Remember all of the panic that scaling laws had hit a wall? Top AI execs say they haven’t seen it, and a new study backs them up. The venture fund Contrary put out its annual 300+ page research report, much of which focused on AI progress. On average, the study found, foundation models are performing better after training on larger data sets with more compute and training experience — in line with the scaling law hypothesis.

You can check out the full Contrary report here, crafted by Contrary’s Kyle Harrison.

Six Notable Deals

Waymo, Cerebras, ElevenLabs, Resolve AI, Osmo & Fundamental

Robocars, chips, voice, and…a foundation model for smells?

Waymo raised $16 billion in a new funding round co-led by Dragoneer Investment Group, DST Global, and Sequoia Capital. Other investors include a16z, Mubadala Capital, Bessemer Venture Partners, Silver Lake, Tiger Global, T. Rowe Price, BDT & MSD Partners, CapitalG, Fidelity, GV, Kleiner Perkins, Perry Creek Capital, and Temasek.

Chipmaker Cerebras raised a $1 billion Series H round led by Tiger Global. Other investors include Benchmark, Fidelity, Atreides Management, Alpha Wave Global, Altimeter, AMD, Coatue, and 1789 Capital, among others.

Voice AI model maker ElevenLabs raised a $500 million Series D round led by Sequoia Capital. Other investors include a16z, Iconiq Capital, Lightspeed Venture Partners, Evantic Capital, BOND, BroadLight, NFDG, Valor Capital, AMP Coalition, and Smash Capital.

Resolve AI, which builds AI agents to debug software, raised $125 million in funding led by Lightspeed Venture Partners. Unusual Ventures, Artisanal Ventures, A* Capital, and Greylock also participated.

Osmo, a startup building a foundation model for smells, raised a $70 million Series B round led by Two Sigma Ventures. Other investors include Alumni Ventures, Valor, Atreides, Amplo, Collab Fund, Lumina Partners, and Stripe’s Patrick Collison, among others.

Fundamental, an AI lab for enterprises’ data, has raised $255 million and emerged from stealth. The company recently raised a $225 million Series A round led by Oak HC/FT, Valor Equity Partners, Battery Ventures, and Salesforce Ventures. It’s valued at $1.2 billion.