Oracle's Unlikely Journey to Data Center Darling Built on Three Contracts & Voracious Investor Appetite for AI

Plus, Y Combinator startups raise fresh funds & OpenAI faces off with California

The Week in Short

Larry Ellison had quite a week as he hitched himself to Sam Altman’s star. Index and Gradient back Y Combinator grads.

Behind the paywall: Mistral AI and PsiQuantum join the decacorn club. OpenAI said to discuss a nuclear option if Gavin Newsom balks on non-profit conversion. California State Senator Scott Wiener’s new AI bill is at issue too. Klarna finally paid off for Sequoia with a strong IPO. Apple’s annual product refresh was panned by bloggers.

The Main Item

Enterprise Software Companies Rarely Reinvent Themselves. Oracle is Suddenly an Exception to the Rule.

A few years ago, Oracle’s GPU rental business was almost non-existent. Coming out of the pandemic it was doing just $10 million in annual revenue and there was internal talk of discontinuing the service altogether, sources told us.

A few things kept it afloat — most importantly Nvidia, which used Oracle’s cloud to host its proprietary DGX Cloud service.

Then the AI boom happened and the infamously late entrant to cloud business got traction by promising cheap access to GPUs, which it had at a time when the cloud giants were full up. Oracle started becoming a quiet AI winner.

After this week, “quiet” couldn’t be a less apt descriptor. CEO Safra Catz announced on the quarterly earnings call that the company had signed a few massive contracts worth a shocking $317 billion and its stock went parabolic, leaping 43% and briefly making Ellison the richest person in the world.

Seeing a 48-year-old database company suddenly grow by more than the size of a Salesforce over the course of a trading day is one of those occurrences that makes you wonder about the moment we’re in. It’s at once incredible, uncanny and terrifying — like your grandfather during a family reunion gathering everyone around, tossing off his walker and doing parkour.

What the hell is going on?

In the case of Oracle, the answer is: OpenAI. Of the massive contracted revenue increase Catz disclosed, $300 billion of it came from the ChatGPT maker, the Wall Street Journal reported.

The next largest contracts were from Meta and Nvidia, sources told us.

Investors have been a bit slow on the uptake, given that OpenAI made it clear at the Stargate announcement back in January that it had chosen Oracle as its main cloud partner. This was just the first time that Oracle had recognized the full financial impact of the relationship.

Oracle hasn’t yet figured out what 4.5 gigawatts of computing capacity will look like. The current thinking involves four new massive facilities, sources tell us, though that could change; the OpenAI deal doesn’t begin until 2027.

All this helps explain the mind-boggling cash burn that OpenAI has been disclosing to investors recently. The Information reported last week that the company now expects to burn $115 billion through 2029 — $80 billion higher than expected. That tracks almost directly to Oracle data center revenue.

That’s the best way to explain Oracle’s stock surge: it’s a way to bet on still-private OpenAI. Incidentally, that’s a mantle Microsoft once held, but it chose to pass on the Stargate gamble.

If you were looking to the Oracle moment to ricochet throughout the rest of the cloud stocks, you’d have been disappointed. Microsoft and Amazon both traded down this week. Google has been up, but that’s likely the lasting effects of the sugar high from skating by in its antitrust case.

There are some worries that Oracle, which is not a cash-rich company, will have to take on a lot of debt to finance its GPU purchases. Brad Reback, an analyst with Stifel, waved away those concerns, noting that large share buybacks over the years left it in a good position to raise capital through share issuances too.

Still, we’re in a moment where a huge amount of equity value is wrapped up in companies that are reliant on a few customers. Oracle’s market cap is singularly driven by its deal with OpenAI. Nvidia’s top two customers make up 39% of its revenue. Anthropic is heavily reliant on Cursor’s usage of its API.

Reback is confident that “AI is not Pets.com. There’s no two ways about that.” Still, he added, the concentration of capital can’t be ignored. “OpenAI represents potential systemic risk for the entire tech landscape.”

It all makes the journey of Oracle’s GPU business a fascinating microcosm for the entire AI boom. In only a few years, something that was once so irrelevant it was in danger of being cut now determines the health our economy.

Newcomer Podcast

From Deus Ex Medicina: Vinod Khosla, Bob Kocher & Annie Lamont

We’re bringing you two of our spicier on-stage conversations from the Deus Ex Medicina summit, which we co-hosted with Smart Girl Dumb Questions host Nayeema Raza, onto the podcast this week.

First up is Bob Kocher, partner at Venrock, and Annie Lamont, founder and managing partner of Oak HC/FT, who each share their perspectives on business models in healthcare, the rise of AI applications, the promise and pitfalls of longevity drugs like GLP-1s, and the future of Medicare Advantage.

Later in the episode you’ll hear from Vinod Khosla as he brings his trademark candor to a wide-ranging discussion about AI’s role in healthcare, regulatory challenges, global competition, and how startups can reimagine the system from the ground up.

Demo Day

Y Combinator Startups Land Term Sheets

Y Combinator hosted its Summer 2025 Demo Day on Tuesday, and as usual in recent years, VCs were writing checks well before any startup founders went on stage.

Design Arena, a crowdsourced benchmarking tool for AI design, got a check from Index Ventures at a $70 million valuation, we were told.

Gradient Ventures led a round into Truth Systems, which is building agents that monitor governance and compliance for enterprise customers, sources said. Lightspeed also participated in that deal.

While this batch was strong overall, there wasn’t one clear frontrunner that everyone was scrambling to back, investors told us. It skewed heavily towards enterprise startups, which made up 44% of the cohort, versus just 10% for the buzzy defense and government tech categories.

One Big Chart

Sparkle Fades for 2021 Unicorns

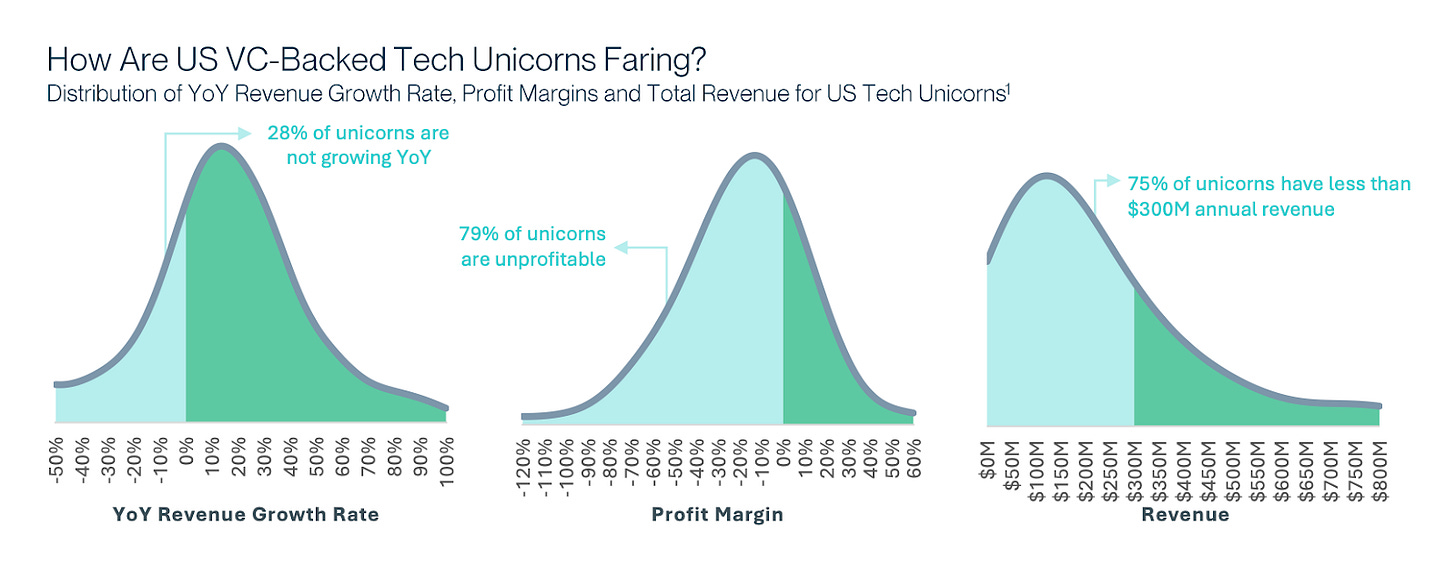

The 2021 funding boom minted more startups with a valuation of over $1 billion than Silicon Valley had ever seen. It’s no secret that many of those companies haven’t lived up to their once-high prices, and new research from Silicon Valley Bank offers fresh detail on the financial performance of this troubled herd.

In 2025, almost 4 out of 5 2021 unicorns are still unprofitable, according to Silicon Valley Bank’s H2 Innovation Economy Outlook report. Only a quarter have at least $300 million in annual revenue, which the report authors peg as the benchmark for an IPO candidate. Twenty-eight percent of the unicorns are no longer growing at all.