OpenAI’s ‘Code Red’ Shows the Power of Perceptions in the AI Race

Plus, Silicon Valley circles up for David Sacks. But why?

The Week in Short

‘Code Red’ at OpenAI as Google & Anthropic surge. David Sacks v. NYT misses the big picture. Unicorn herd gets richer. Kalshi & Polymarket go gambling. US government invests in laser startup. Harvey, Curative & Eon raise fresh funds. Apple shakes up AI leadership. Meta to cut Metaverse. FDA chaos imperils biotech. Trust & safety workers in Trump crosshairs.

GiveDirectly

Newcomer Contribution Matches Are Still Live

Many thanks to our subscribers for supporting our @GiveDirectly campaign. Substackers have raised about $1 million to date for cash assistance to alleviate extreme poverty. You can catch up on it here and we’re still matching your donations at givedirectly.org/newcomer.

The Main Item

As the AI Narrative Shifts to Google & Anthropic, Sam Altman’s Media Mastery is Put to the Test

With AI investment holding up the global economy and the foundation model race continuing at a fevered pace, CEOs are leaning into the adage from the prescient Google researchers whose 2017 paper kicked off the current boom: attention is all you need.

Over the past couple of weeks, the attention has been going to Sundar Pichai and Google, whose new Gemini 3 model won wide praise and topped the leaderboards that measure performance. And it’s been going to Dario Amodei and Anthropic, whose “we’re safer” message — along with a top-notch model that’s especially good at coding — is resonating with business customers. Anthropic is now starting down the road to an IPO, which promises lots of publicity too.

Where does that leave Sam Altman and OpenAI, which have dominated the AI storyline to date? He declared a company-wide “Code Red,” which involves delaying some initiatives and shifting resources to an all-out effort to further improve its core models. Altman also praised Gemini and told employees, “I expect the vibes out there to be rough for a bit.”

That might sound like a CEO giving a sober assessment of the state of play and rallying the troops to do more, faster. But in an AI race with unprecedented multi-trillion-dollar stakes, nothing is quite so simple.

In truth, as Newcomer’s Tom Dotan wrote back in April, Google, with all of its formidable assets, was never very far behind. Nor is it currently very far ahead. Anthropic too has always been essentially neck-and-neck with OpenAI on the core technology.

The capabilities of the big foundation models, and even some lighter ones like DeepSeek, are broadly similar. Marc Benioff, himself a skilled practitioner in the arts of attention, even claimed this week that the big models will be interchangeable commodities, like disk drives.

Yet the perception of who’s on top matters quite a lot at a moment when consumers, enterprise technology buyers, and investors are all deciding where to place some highly consequential long-term bets. That brings us back to Altman’s “Code Red.”

First off, while the alarm came in a company-wide memo that wasn’t officially announced publicly, we can stipulate that the “leak” of the memo, if not necessarily orchestrated, was almost certainly part of the plan. A media maestro like Altman surely knew that a memo going out to thousands of employees with charged language like “Code Red” was all but guaranteed to make its way to the press.

Publicizing a panicked internal reaction to a competitor’s new product might seem like a counter-intuitive way to maintain your reputation as the industry leader.

Yet if history is a guide there’s a good chance OpenAI’s next model will match or surpass Google. Now, when it’s launched, Altman will be able to declare “Code Red” a smashing success, gaining some extra publicity and coming across as a decisive leader who did the tough things when it mattered and put his company back on top.

An even simpler dynamic is likely part of the mix too. The “Code Red” memo kept OpenAI in the headlines, and being in the headlines is a core competency of the company and its CEO (and we don’t mean that sarcastically). Altman’s brilliant leveraging of the company’s first-mover advantage to build a global brand overnight and become the face of the AI revolution has itself been a big contributor to the unprecedented uptake of ChatGPT.

If what you’re saying internally to your troops about a competitive challenge is front-page news in The Wall Street Journal, one of the messages there is that you’re the market leader. Why else would anyone care?

Altman and OpenAI are so good at making news that it’s sometimes hard to tell what’s real. Altman this week also featured prominently in the Journal for kicking around plans to compete with Elon Musk’s SpaceX. The talks are “no longer active,” the company whispered to the paper. But still, there it is in The Wall Street Journal (and here in Newcomer).

How a company is perceived always matters to its value, of course. But in AI, the combination of the high stakes and the many, many unknowns has made perceptions a much bigger driver than they might be otherwise.

Anthropic’s Amodei can’t match Altman as a natural marketer, but he’s now playing the media game exceptionally well himself, leaning into his public profile as the AI CEO most concerned with safety and security.

It’s hard to know how much of Anthropic’s success in the enterprise can be traced to safety concerns. But it’s probably not a trivial factor. In his comments at the DealBook summit this week, Amodei jabbed at his competitors for behaving too recklessly with their data center capex — a nice backhanded way of stressing Anthropic’s responsible approach.

News that the company is preparing for an IPO as soon as next year can also be seen as reinforcing this messaging: IPO’s bring transparency and accountability, not to mention a ton of publicity.

All of this underscores just how early we still are in the foundation model race. Eventually, a few companies will likely emerge with better technology and/or shrewder marketing that will be evident in financial results. Until then, attention may not be all you need, but it helps quite a bit.

Conflicts of Interest

The NYT Gave Tech an Excuse to Curry Favor With Trump’s AI Czar

Newsflash: AI & crypto czar David Sacks and his buddies will do well if Trump stays friendly to artificial intelligence and crypto.

That was the conclusion of a New York Times story on Sunday that declared, “Silicon Valley’s Man in the White House Is Benefiting Himself and His Friends.”

The heart of the analysis seemed to be that Sacks’s undivested Craft Ventures startup holdings are branding themselves as AI companies and that Sacks wanted his podcast empire to benefit from his Trump ties.

No shocker on either front.

What startup isn’t an AI company these days? And what rightwing podcast isn’t desperate to book the president.

The crypto industry helped buy the Trump presidency: the American public should have been well aware it was going to get favorable treatment in Trump 2.0.

The Times story reads like a long-simmering reporting project that never quite came up with a smoking gun. By the standards of self-dealing in the Trump administration, Sacks comes off looking comparatively innocent. He’ll likely benefit from a lax regulatory stance toward AI — like anyone with tech investments right now — since the whole American economy seems to be hanging on a massive AI build out.

After the nothingburger came out, Sacks and the tech elite way overreacted, circling the wagons on X.

Max Levchin, Marc Benioff, Sam Altman, Marc Andreessen, and others came to his defense with Sacks obsessively retweeting his supporters and lambasting the New York Times. (I’m surprised they were so willing to signal how much they seem to care about what the Times has to say.)

The tech elite’s response seemed more troubling than anything in the NYT story. Sacks, who is charged with guiding the administration’s AI policy was watching all-too-closely who came to his defense. He quipped in a quote tweet of OpenAI CEO that he was “still waiting” on Anthropic CEO Dario Amodei to come to his defense.

Sacks seemed to be enjoying receiving his small version of the obsequious flattery that Trump has extracted from the tech industry.

I can see why someone so contemptible would relish the opportunity to hear nice things about himself.

But it’s a sad state of affairs that anyone should feel compelled to say them — or else fear what the federal government might do to their tech business.

— Eric

One Big Chart

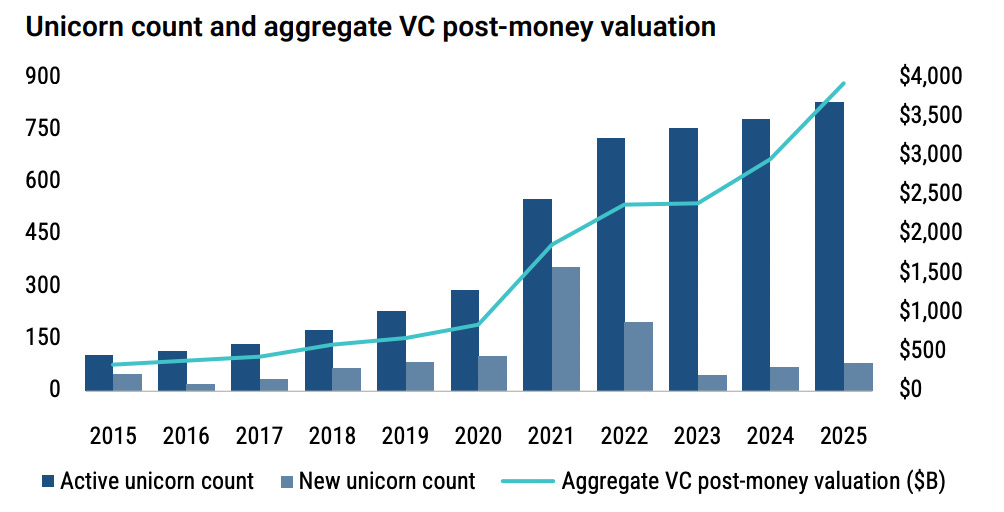

Unicorns Are Getting Rarer — But More Valuable

2025 wasn’t a year that minted that many new billion-dollar startups, but at least by recent measures, the unicorns herd is getting more valuable.

Per PitchBook’s 2026 First Look report, the aggregate post-money valuation for all unicorns is now close to $4 trillion. That’s a tenfold increase in value over the last ten years, the highest total on record, and a nearly $1 trillion jump from last year.

There were more new unicorns minted this year than last, though the number remains far below the 2021 peak. The report shows that a lot of the aggregate valuation bump comes from the highest quartile of Series C and D rounds over the the past two years. That tracks closely to the AI boom.