OpenAI's Challenge: Pursuing a Trillion-Dollar IPO While Building Public Trust

Plus, Navan shares sink post-IPO while Google & Amazon soar

The Week in Short

OpenAI announces its new structure, with the biggest-ever IPO on the horizon. European dealmakers are scoring wins, but fundraising lags. Bending Spoons revives dead brands to reach $11 billion valuation. Food & shopping startups are back, alongside buzzy AI deals like Applied Compute. Navan gets its IPO out, but shares drop. AI-driven layoffs are on the rise. Forge Global wobbles as secondary market prices stay muted. Big Tech investment spree accelerates, but Meta shares fall on spending concerns.

The Main Item

Sam Altman & Bret Taylor Got Microsoft & California’s AG on Board With OpenAI’s Restructuring. Now Comes the Hard Part.

The ink was barely dry on OpenAI’s deal to resolve its corporate governance issues when the chatter turned to a possible IPO, which Reuters reported could come as soon as the second half of next year. It would almost certainly be the largest public offering ever by a wide margin, when the AI leader could raise $60 billion or more at a valuation of around $1 trillion.

There are of course a thousand contingencies for any such event, with the most important being buoyant capital markets and continued retail investor enthusiasm for all things AI. During a week in which Nvidia hit a $5 trillion valuation, just three months after crossing the never-before-seen $4 trillion threshold, loose talk about a trillion-dollar IPO is just another day at the office.

Wherever you stand on the AI bubble question, the extraordinary acceleration in valuations we’ve seen over the past year will certainly slow at some point, at a minimum. Earnings from Google, Microsoft, Amazon, and Meta this week suggest demand for AI compute is far from sated, but there’s growing scrutiny of the business case for huge capital investments.

The Cerebral Valley AI Summit is sponsored by MongoDB

If you’re building something ambitious, MongoDB for Startups helps you scale it. The program gives founders real resources to move faster and spend less. What you get:

Free MongoDB Atlas credits to power your product from day one

200M Voyage AI tokens to jumpstart AI development

1:1 guidance from MongoDB engineers for architecture and optimization

Partner and co-marketing support to grow visibility and reach

Apply to MongoDB for Startups →

As Tom noted a month ago, OpenAI is now holding up valuations all across the industry. Sam Altman has brilliantly positioned the company as the public face of the AI revolution, and there’s no arguing with the unprecedented success of ChatGPT.

Yet the IPO chatter also underscores the extent to which the AI industry has become a capital arms race like we’ve never seen before. And there are dangers there even beyond the obvious one that any sign of a slowdown either in AI adoption or model improvement — not to mention a broader market downturn — could quickly dampen investor appetite for speculative AI bets.

In their relentless race to raise more money and build faster than the next guy, OpenAI and the rest of the industry have to be very careful not to lose their product focus.

The public has been wowed by the sheer magic of generative AI, and its usefulness for common research and fact-finding tasks. The business world has been taken with AI’s coding abilities especially, and its clear potential to automate untold numbers of difficult tasks.

Yet it’s important to keep in mind that in America, more than in most countries, polling reveals deep suspicions and fears about what AI will bring, and a big disconnect between industry leaders and the public. Big Tech companies are about as trusted as banks and labor unions, according to one recent survey — which is to say, not very trusted — and public faith has declined significantly over the past few years.

“Trust and safety,” until recently an integral function at major tech firms, has been discredited by political attacks from the MAGA movement, led by Elon Musk. Yet the idea that big companies need to police their platforms and be cautious with potentially dangerous product features — a consensus idea until recently — still seems like common sense, not to mention a legal necessity.

OpenAI has tried to have it both ways on the public good, with a non-profit charter requiring it to develop AI “for the good of humanity” even as it pursues ravenously capitalistic business strategies. The non-profit that will now own about a quarter of OpenAI will be incredibly wealthy on paper, though it won’t have much cash, at least for the moment. Spinning its new “public benefit corporation” as a guarantee of good behavior is a bit disingenuous — the PBC requirements are mostly general and self-reported — and isn’t the kind of thing that’s going to build trust by itself.

Altman has done an incredible job in portraying himself publicly as an honest broker who will do the right things, even as he courts anyone and everyone who might be willing to throw down a few billion. He and OpenAI board chair Bret Taylor assuaged California attorney general Rob Bonta by promising to keep the company in California, and the company has recently taken some steps on child safety.

(Altman and Taylor also appeased Microsoft, which agreed to reduce its equity stake from 32.5% to 27% in exchange for extending its rights to OpenAI IP to 2032, though Musk’s lawsuit still looms as a risk to the new agreement.)

But the specter of AI taking jobs, polluting public discourse, endangering children and the mentally ill, and benefitting a wealthy elite at everyone else’s expense is on a lot of peoples’ minds.

With the laudable exception of Anthropic’s Dario Amodei, most of the industry, as well as the Trump Administration, aggressively rejects the idea that there’s any role for regulation. Yet the notion that everything will be just fine with the industry policing itself is unlikely to wash with the public over the long run.

Maybe the answer is smart regulation. Maybe it’s restoring the legitimacy of “trust and safety” as a central function, with real teeth on product choices. But one way or another, OpenAI and the rest of the industry would do well to recognize that nothing will pop their valuations faster than a political backlash that they didn’t see coming.

One Big Chart

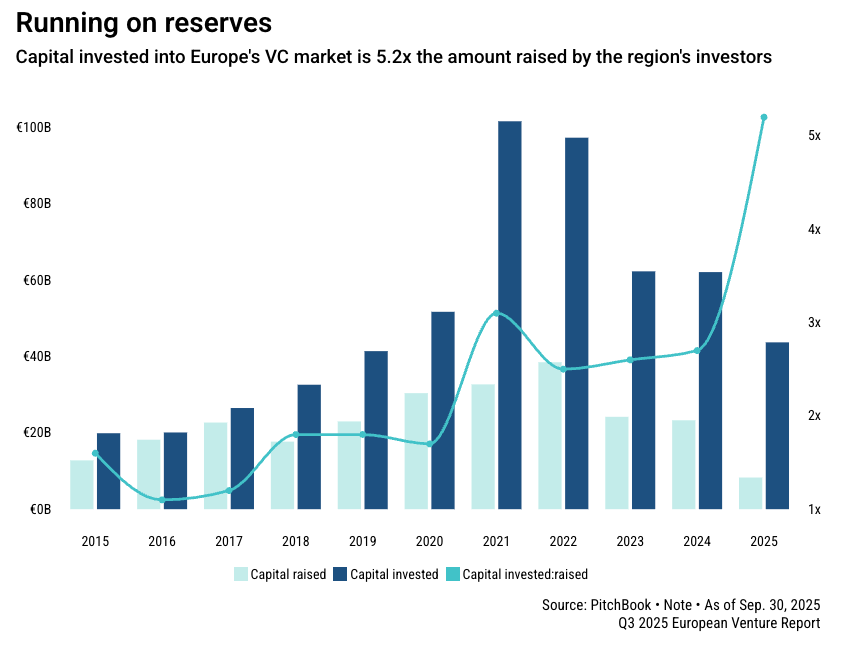

European Dealmakers Post Wins But Fundraising Lags

2025 has been a rebound year for dealmaking but investor fundraising has taken a hit, and the disparity is especially visible in the European market.

Capital invested in startups on the continent has outpaced European VCs’ fundraising by a multiple of 5.2x, per new PitchBook Data.

Lots of hot AI startups have come out of Europe recently, including Synthesia, Lovable, and ElevenLabs. But Europe has a higher concentration of emerging managers, and they’ve struggled to bring in the funds to match the deal frenzy.