Investors Rush to Get Figma Shares in Blockbuster IPO

Plus, why Dylan Field's company is a unicorn among unicorns & big tech's AI-powered earnings boost

The Week In Short

Figma’s IPO popped by more than 3x during trading Thursday for the biggest first-day gain in years, but don’t hold your breath for the next one like it. The IPO window has actually been pretty open, says Compound’s Michael Dempsey, and perhaps we’re at the tail end of it.

Behind the paywall: Ramp raised another funding round that juiced its valuation to $22.5 billion. Microsoft and Meta juiced the markets with their impressive earnings calls. European creators turned against the continent’s AI Act. VC marketing pioneer Margit Wennmachers left a16z.

The Main Item

Figma’s IPO Is a Classic Venture Grand Slam. It’s Also a Tough Act to Follow.

Figma ringing the bell at the New York Stock Exchange Thursday and seeing its shares skyrocket by more than 3X when trading opened was a celebratory moment that’s been all-too-rare in the venture industry of late.

It’s not just that Index Ventures, Greylock, Kleiner Perkins, and Sequoia all stand to post ten-figure gains on their investments, with Index looking at a return of more than 1000x based on Figma’s soaring share price. Nor is it merely the huge first-day pop, which along with the success of few other recent offerings is likely to lure fresh IPO candidates to the market.

It’s that Dylan Field and Figma represent the best of the best of what venture capital can bring to the world. The company and its backers won big by doing it the old-fashioned way, building the company at a measured pace over more than a decade. It’s something the venture industry needs more of as it figures out its future.

With Figma, there’s no fancy arbitraging of GPUs, or scrapping for margins on consumer lending, or worrying about whether your roll-up is actually good for customers, or loading up a bazooka of cash to blow away competitors.

Instead Field, who by all accounts was a born founder, came up with a very good product idea: browser-based design software, which had the potential to open up design in interesting ways and offer new types of collaboration. It was a steep technical challenge, but thanks to his already-impressive track record in college he got a Thiel fellowship in 2012, and the next year raised a seed round of $3.9 million, with Index taking about half and an Iconiq consortium also participating.

Then Field and his co-founders worked on the product for a couple of years before raising a $14 million Series A. Then they worked on it for three more years before raising a $25 million Series B in 2018. They raised $40 million the next year and $50 million the year after that and then $200 million in 2021.

This is how venture capital is supposed to work. Give a great founder with a great idea some money, and as the company makes progress put in a little more. Rinse and repeat, and if everything goes absolutely perfectly you eventually get to an exit like Figma’s.

It’s very different from many of today’s big startups, which sometimes look like fund-raising operations with a tech business on the side. And many small startups position less as long-term bets on an exciting idea than as targets for a quick acquisition — or an acqui-hire.

Money on the Table?

Figma’s extraordinary first-day performance suggested the company had priced its shares too low, even after raising its projected range and pricing above it. Companies and bankers like to see shares rise after a debut and big spikes are not uncommon in frothy market moments, though in this case it’s fair to say that Figma left money on the table.

Still, there’s an upside for the industry in the excitement sparked by Figma’s performance. Upfront’s Mark Suster said it demonstrated that retail investors are hungry enough for tech stocks that they’ll pay a premium.

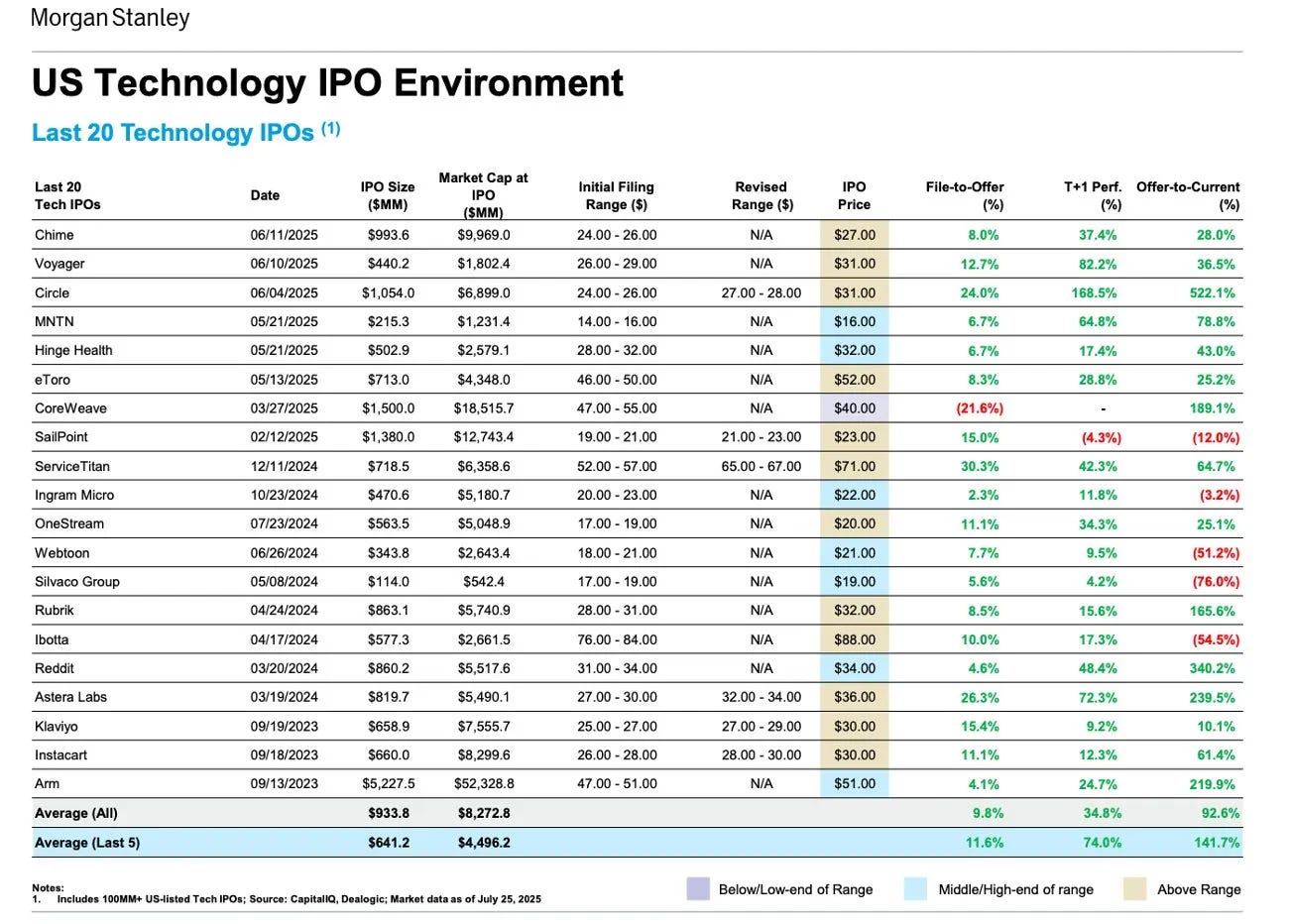

“That probably creates some window where more people realistically believe they can do well in the public markets,” he added. The handful of recent tech IPOs, including CoreWeave, Hinge Health, and Reddit, have mostly performed very well, with public markets continuing to push higher even in the face of tariff uncertainty.

The recent return of meme-stock mania is another indicator of retail investor appetite for stocks, though it’s also a sign of froth.

FirstMark’s Rick Heitzmann texted us that the IPO window was open “across the board” for tech companies, regardless of sector. Klarna, the Swedish fintech that pulled back on an IPO in March, is now eyeing a September debut, Bloomberg reported. Ticket broker StubHub and robo-advisor Wealthfront are among the other candidates that investors believe could go soon.

It’s unlikely there will be a sudden parade of new offerings though. Figma’s success was in some ways a perfect storm: the IPO hit at a moment when public markets were near record highs — powered by retail investor appetite for tech stocks in particular — and the company had an especially compelling proposition.

Mixed Outlook on IPO Pipeline

But there aren’t that many relatively mature, profitable, category-busting software startups like Figma out there. Compound’s Michael Dempsey says the IPO window has actually been pretty wide open, and the companies that have gone out have mostly done well. But he’s not sure it will last, pointing to the risk of fresh tariff shocks in August.

“I think many CEOs waited too long to get public,” he said. Other investors agreed that tariffs were the biggest overhang for IPOs going forward.

For some of the startups waiting in the wings, regulatory scrutiny has been a big issue. Chip-maker Cerebras pushed its listing as security risk-assessments drag on, and online retailer Shein’s path was made extra complicated by US-China tensions. Clarios hasn’t come back to market after it withdrew its planned offering in January.

Plus, the private markets are still too rich to coax some of the most obvious IPO contenders to try the public ones. As we wrote last week, the deregulatory bonanza from the Trump administration has juiced private markets of all types. Big secondary offerings are now routine, and have helped keep monster companies like Stripe and Databricks in private hands.

There’s also the over-valuation problem facing companies that raised big rounds in 2021 especially, though recent offerings like Chime and Hinge Health have shown that down-round IPOs can be just fine.

Even if the IPO outlook is not all roses, though, Figma has done the markets another service that should stand the test of time.

The company went public only because European regulators were poised to block the $20 billion sale of the company to Adobe. At the time the deal looked like a spectacular outcome for Field and his backers, and opponents of Biden-era antitrust regulation seized on its collapse as an example of the damage being done to the startup ecosystem by over-regulation.

But the IPO ultimately turned out to be much, much better for everyone involved, save Adobe. Even in the big-tech era, the best startups can go it alone. Long live the IPO!

Newcomer Podcast

Index Ventures’ Danny Rimer Wins Big on Figma

Index Ventures’ Danny Rimer, who led the first round into Figma, shares their origin story the week of its blockbuster IPO.

We pick Rimer’s brain on vibe coding, how Figma turned around from the failed Adobe deal, and where the biggest consumer opportunities are in AI.