Here's What Your Fellow Venture Capitalists Are Getting Paid

We've got the numbers on VC compensation from a Venture5 survey

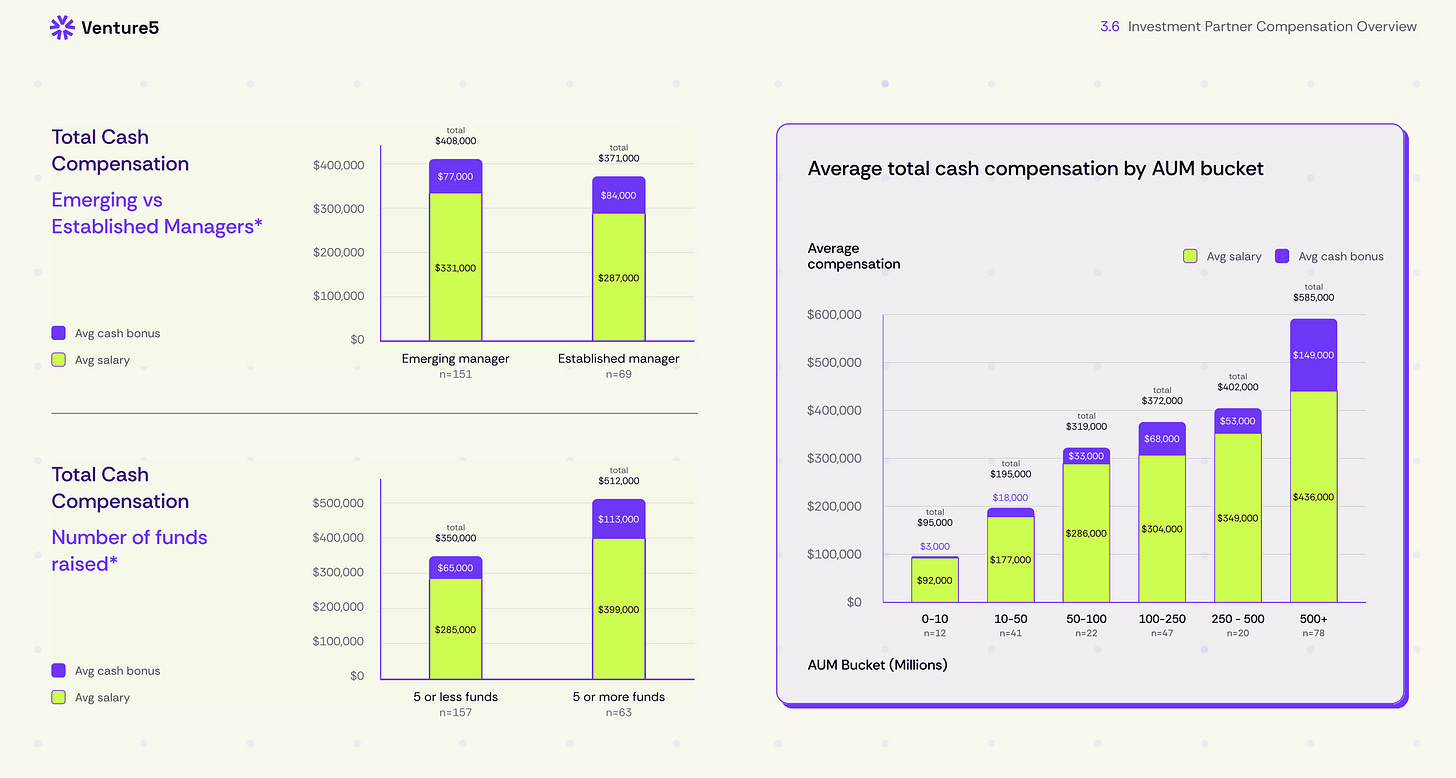

If you want to make a lot of cash in the venture capital business, stack funds.

Venture capitalists at firms with five or more funds are bringing in an average of $512,000 a year across their salary and bonus, compared to $350,000 from firms with fewer than five funds. That’s not even counting carry, which VCs say climbs with their assets under management.

Overall, VC salaries have been relatively flat over the past few years. In 2022, investment partners at venture capital firms reported an average of $296,000 in annual salary. By 2025, that number had climbed 7% to $317,000.

Obviously there are all sorts of venture capital firms out there. I expect many of our readers are above average. If that’s you, congratulations.

The survey results come from our friends at Venture5, a venture capital media and data company. They received responses from 509 people.

I pulled some of the most interesting slides for Newcomer readers but you can see the full deck on their website, which includes breakouts for analysts, associates, operating partners, and more.

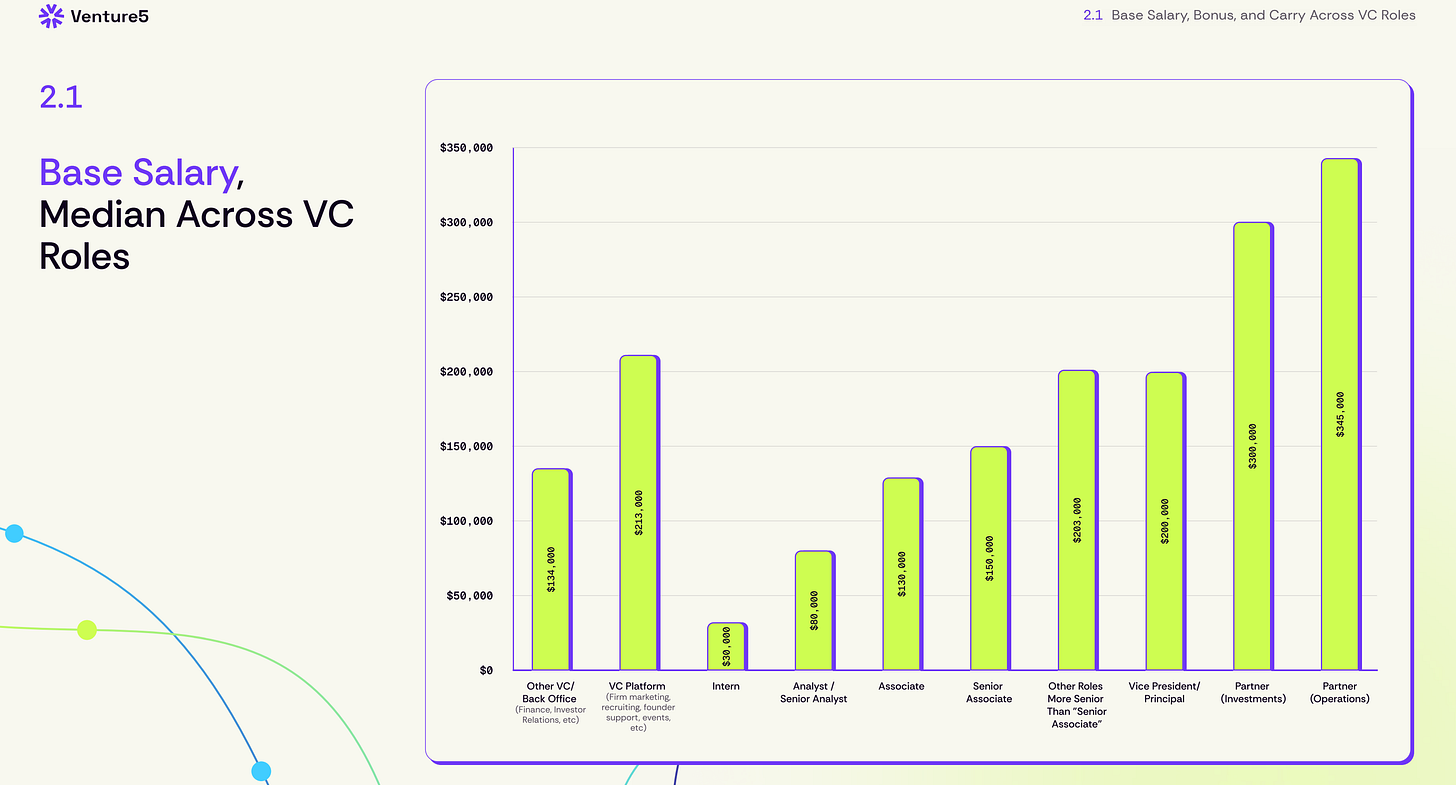

Compensation Across Roles at VC Firms

What Roles Are Getting Carry?

Compensation for Investment Partners

I was surprised that emerging managers reported that they were taking home more cash than established managers.

John Gannon, founder of Venture5, wrote to me, “The emerging manager category includes a meaningful number of ‘second act’ fund managers — former founders or executives who stepped away from operating roles and raised a fund from their personal networks. Those LPs (mostly or exclusively HNWs and family offices) are typically less focused on GP salary than institutional allocators would be. That’s pulling the average up.”

Investment Partner Comp Over Time

Tough to Be an Analyst in the Age of AI

Analyst compensation fell by more than 25% from 2024 to 2025 with analysts last year receiving an average salary of $78,000.

The Venture5 team told me, “We attribute the steep decline of Analyst comp over the last couple of years to the proliferation of off-the-shelf AI and data tooling, which are compressing demand at the bottom of the stack for tasks that once required junior headcount (e.g. market mapping, deal sourcing, competitive research).”

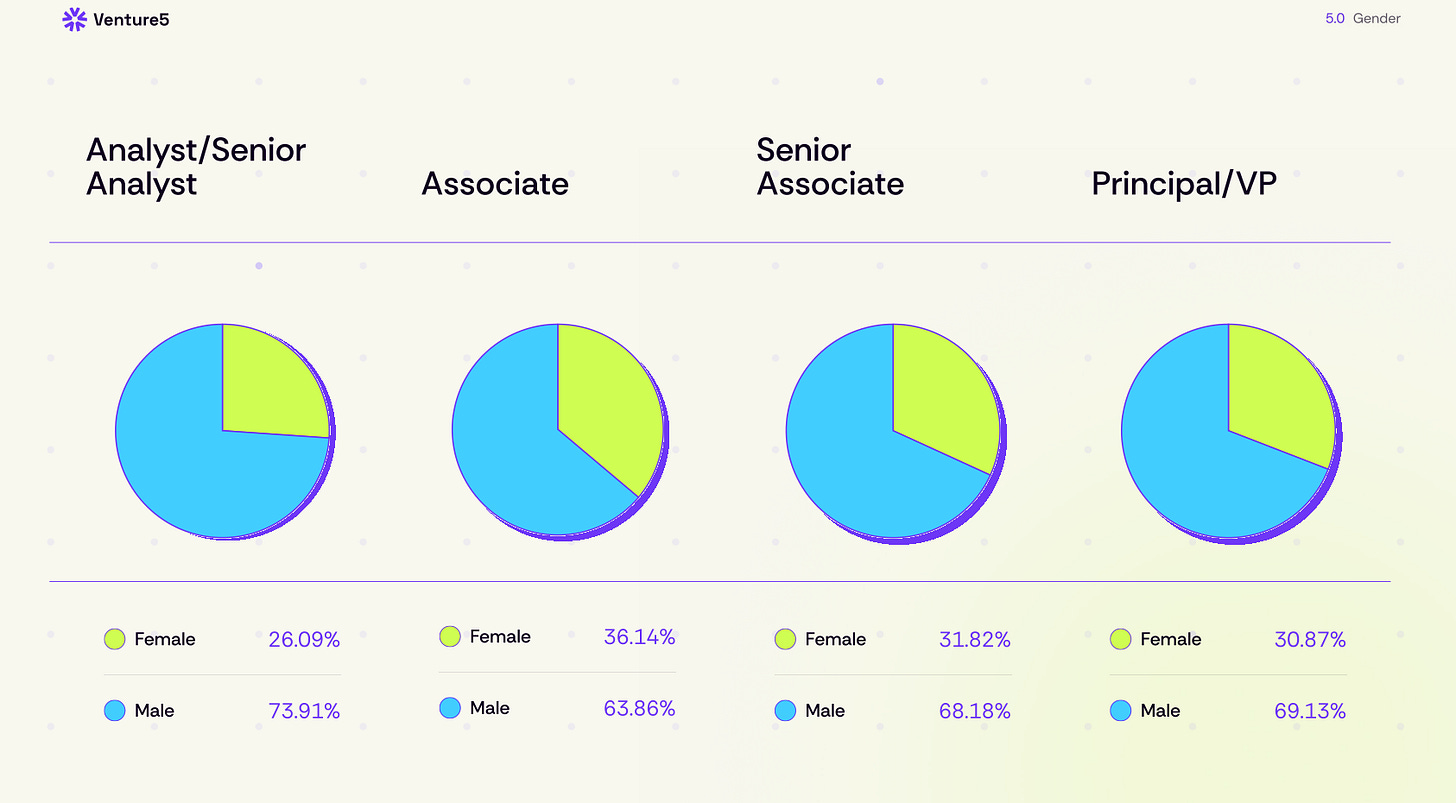

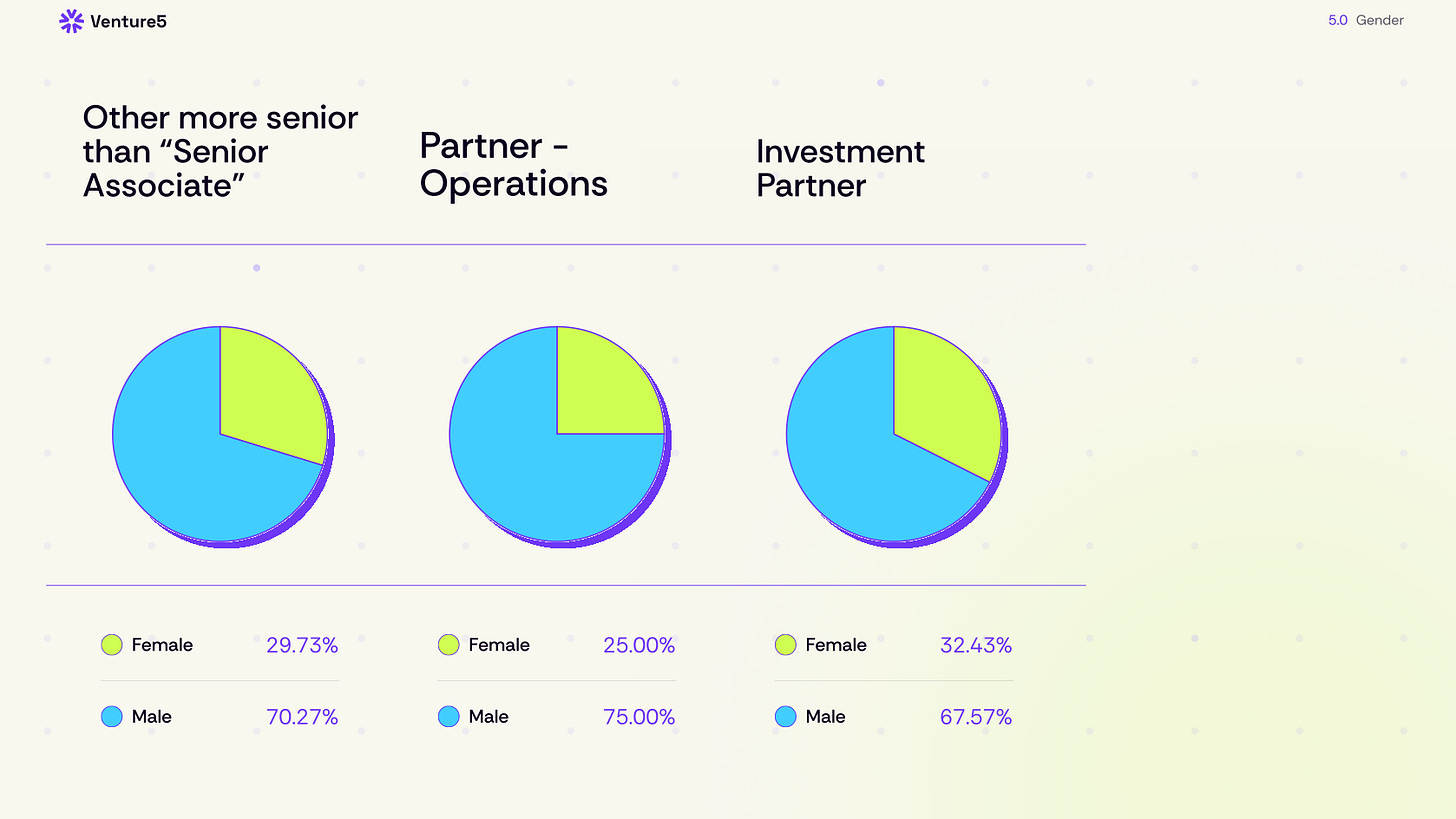

Venture Capital Remains Very Male

Men still vastly outnumber women at venture capital firms. Women make up the largest share of associate jobs at 36%.