Cheerfully Noshing on Sushi at Silicon Valley Bank While The Tech World Is Supposed To Be Crumbling

Is this really what the tech apocalypse looks like?

I spent the day yesterday at a gathering for up-and-coming, striver venture capitalists organized by one such plucky principal — Slow Ventures’ Yoni Rechtman.

The intimate conference, held at Silicon Valley Bank’s Manhattan office, featured appearances from Union Square Ventures’ Rebecca Kaden, Founders Fund’s Everett Randle, Slow Ventures’ Will Quist, and Not Boring newsletter writer and investor Packy McCormick. Josh Wolfe, founder of Lux Capital, teleconferenced in.

I moderated a panel that asked “WTF Is Happening?”

The event was held under the Chatham House Rule, so I can’t tell you who said what. But I can relay the ideas that emerged, and, perhaps most tellingly, the mood.

It didn’t feel like the end times.

Do they cater sushi lunches in an apocalypse? Maybe so. I’ve never lived through one before.

Yes, there was plenty of talk about the pace of investing slowing. But, everyone agreed that money was still flowing into seed and Series A rounds.

True, new fund managers seemed more apprehensive than usual about whether they would get their funds over the finish line. But, limited partners were on hand to give tips and tricks.

Yes, I talked to someone who was leaving their job — but they had a better one lined up.

I didn’t see anyone handing out resumes or asking about job openings.

Just like in roaring 2021, a healthy amount of time was dedicated to worrying about whether ambitious venture capitalists needed to tweet more. It’s not exactly how I would imagine spending the days preceding a startup bloodbath of historic proportions.

I sincerely don’t know what to make of the vibe. People seemed to agree that we have bankruptcies ahead of us. But if they were truly afraid, they hid it well.

I want to be clear that I’m not tweaking anyone for serving conference sushi. It wasn’t exactly Nakazawa. I just always imagined doom and gloom would feel doomier and gloomier.

The warning signs seem to be piling up. Coinbase, a company that has gone to great lengths to reassure people that it’s not at risk of bankruptcy, announced Thursday that it was pausing hiring and rescinding job offers. Elon Musk seems to be begging employees to quit by forcing them to spend at least 40 hours a week in the office. (Indeed, Reuters reported that Tesla wants to cut 10% of jobs.) Sheryl Sandberg thought now was the right time to make her exit. Seven startups laid off workers Thursday; eight laid off employees Wednesday.

But the NASDAQ Composite was up 8% over the last five days. So why worry?

Maybe we’re living a moment out of Nietzsche. The Madman arrives to deliver his message to the people, but they can’t yet appreciate it.

“I have come too early,” he said then; “my time is not yet. This tremendous event is still on its way, still wandering; it has not yet reached the ears of men. Lightning and thunder require time; the light of the stars requires time; deeds, though done, still require time to be seen and heard. This deed is still more distant from them than most distant stars—and yet they have done it themselves.”

Sadly, a prophetic madman didn’t even make an appearance at the conference. Or maybe he arrived after I left.

If people were looking to me for soothsaying, I failed them. Honestly, I’m far more worried about making a bad prediction than I’m terrified by the prospect of the end of the startup world as we know it.

I entered college during the Great Recession, so I grew up with the financial crisis at the back of my mind. But I’ve built a career in the good times. This is my first real downturn — well — except the pandemic head-fake that taught us not to sweat a sudden stock market correction.

Did we learn the wrong lesson?

I’m not exactly running scared myself. I caught myself boasting to one attendee that I thought my newsletter business would prove countercyclical.

Isn’t that what we all want to believe?

What I’m Reading

Tiger Global’s 52% Plunge Prompts Fee Cut, Redemption Plan | Bloomberg

As a make-good to its limited partners, Tiger Global loosened some of its investment terms and lowered management fees by half a percentage point.

Bloomberg reported:

To compensate for putting their illiquid bets in so-called side-pocket accounts, Tiger is allowing clients to pull more of their cash regardless of any lockup terms. Customers can redeem as much as 33% of their investment this year — up from the usual limit of 25% from the hedge fund and 20% for the long-only product. The changes are temporary, and Tiger Global plans to revert back to all-cash redemptions “as soon as it is prudent to do so,” it said in the letter.

Tiger’s hedge fund also has a modified high-water mark, meaning that until the fund makes up well more than 100% of lost investor cash, it will charge a reduced performance fee of 10% on gains, rather than the typical 20%.

The value of Tiger’s private holdings have likely been decimated alongside the public portfolio, but those companies will be much slower to mark down their valuations.

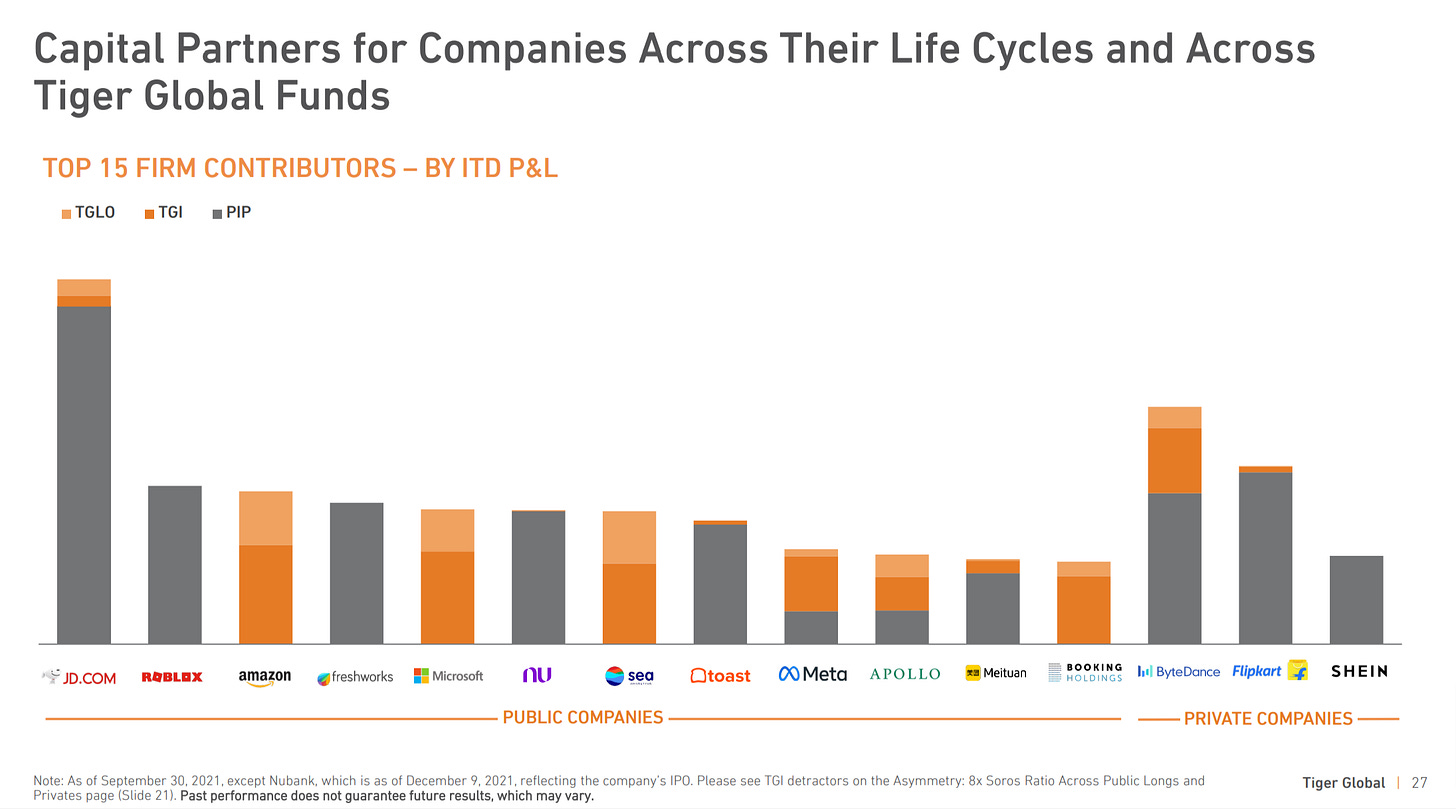

Here were some of Tiger’s biggest positions, according to a recent investor presentation that I published.

Tech Valuations Tumble, but Business Software Stocks Are Cushioned by the Cloud | WSJ

IBM is up 4.3% from the start of the year! It isn’t the stock that I would have picked to hedge against a tech downturn. The Wall Street Journal reports:

Information-technology companies including International Business Machines Corp., Hewlett Packard Enterprise Co. and Oracle Corp. have shown resilience amid a rout in technology stocks. All three have so far outperformed declining market benchmarks since the start of the year.

As of Wednesday, the tech-heavy Nasdaq Composite Index had fallen more than 23% since January. Over the same period, share prices for IBM, which sells cloud-based enterprise software and services, rose 4.3%.

Prices for HPE, a business software firm spun off computer maker Hewlett Packard, have held roughly steady. On Wednesday, the company reported $6.7 billion in sales for the quarter ended April 30, up 1.5% year-over-year, with online software orders roughly doubling from the previous year.

Uber’s Troubled Past Haunts Criminal Case of Former Security Chief | Bloomberg

I broke the news of Uber’s data breach several years ago at Bloomberg and wrote about many of the company’s many legal problems. So it’s a story that I’ve followed with great interest. In the Dara Khosrowshahi era, those legal issues largely seemed to wash away. And Donald Trump cleared another one by pardoning former Uber autonomous vehicles executive Anthony Levandowski. But one case has continued to hang over Uber. Its old chief security officer Joe Sullivan, a former federal prosecutor, faces criminal charges from the breach. But he seems to be arguing that Uber is trying to pin the blame on him unfairly.

Bloomberg’s Joel Rosenblatt:

Sullivan, a former federal prosecutor and longtime Silicon Valley fixture who previously headed security for Facebook, faces as long as 20 years in prison if convicted of the most serious charges against him — though his sentence would likely be far less.

He spent 2 1/2 years at Uber and gained a reputation as a fixer for then-CEO Travis Kalanick before a series of scandals drove the co-founder out of his job. Khosrowshahi then set out to clean house.

Why Sheryl Sandberg Quit Facebook’s Meta | WSJ

Every newsroom is trying to answer why exactly Sheryl Sandberg is leaving Facebook now. Fortune attributed it partly to Roe v. Wade. I find that one hard to believe.

The Wall Street Journal has perhaps the most credible attempt so far to explain why Sandberg left — though the paper certainly goes to great lengths to center its own reporting in the explanation. But besides facing a number of questions around Sandberg’s decision-making, the paper also points to burnout:

Ms. Sandberg has been telling people that she feels burned out and that she has become a punching bag for the company’s problems, the people said. “She sees herself as someone who has been targeted, been tarred as a woman executive in a way that would not happen to a man. Gendered or not, she’s sick of it,” said one person who worked alongside Ms. Sandberg for many years.

Meanwhile, Sarah Frier at Bloomberg points out, amusingly, the endless speculation over the years about Sandberg’s imminent departure.

Finally, any day now has come.

Frier wrote:

A former Facebook employee recently joked with me that Sheryl Sandberg has been on her way out of the company since at least 2011, but it’s never been the right time for the executive, who is hyper-sensitive about her own reputation, to leave.