Capital-Intensive 'Coconut' Rounds Upend the Traditional Venture Funding Model

We talked with Thomas Dohmke, Martin Casado, Naveen Rao & more about the massive new AI seed rounds shaking up venture capital

Last week, Thomas Dohmke, the former CEO of GitHub, announced a $60 million seed round and a $300 million valuation for his new startup Entire, a developer platform focused on AI-generated code. By the standards of today’s AI market, that’s considered restrained.

Dohmke initially floated a $50 million raise to Madrona Ventures’ managing director S. “Soma” Somasegar — once the head of his division at Microsoft — who suggested a $250 million valuation. Dohmke said he would come back after testing the market, Somasegar told me.

One VC who was assessing the round from afar thought Entire could go as high as $700 million. Eventually Dohmke came back to Somasegar, and they settled on the $60 million at $300 million.

Whether that outcome reflects a market ceiling or a disciplined approach is an open question.

We’ve gotten to a place where megasized seed rounds come across regularly and we don’t bat an eye. Fei-Fei Li’s company World Labs launched in 2024 with $230 million in initial funding. Ilya Sutskever’s Safe Super Intelligence raised $1 billion in funding out of the gate in 2024. And Mira Murati’s Thinking Machines launched with a $2 billion seed round. Last month, another AI research lab started by former Anthropic, xAI, and Google engineers, called humans&, launched with $480 million in funding at a $4.48 billion valuation and a writeup from The New York Times.

See below for our full list of the largest seed rounds in the last 2 years.

(Ed Ludlow at Bloomberg suggested renaming these large seeds “coconut rounds,” which I like in a Margaritaville sort of way. But I bet Aileen Lee can come up with something catchier. Unicorn Eggs?)

Entire’s seed round is modest by comparison, which is somewhat astonishing in itself. Somasegar chuckled when describing how far things have gone. “The notion of seed is all over the place now,” he said. “It’s the first round of capital but it varies from $1 million to a billion dollars.” There’s a marketing dimension to the big raises too. “Saying ‘60’ and ‘seed’ is just the new way of thinking about things.”

Dohmke said he wasn’t thinking about maximizing valuation early — just being practical. “We focused on the capital needed to build and scale a new developer platform that reinvents the software development lifecycle with AI agents,” he told me over email, pointing to a blog post by investor Felicis Ventures partner Aydin Senkut as evidence of alignment.

But interestingly, the post itself leaned into the scale — proclaiming the round “the largest in developer tools history” and comparing the company’s ambition to the Model T assembly line. For VCs, the size of the seed checks they write is becoming part of another flex to boost their brands.

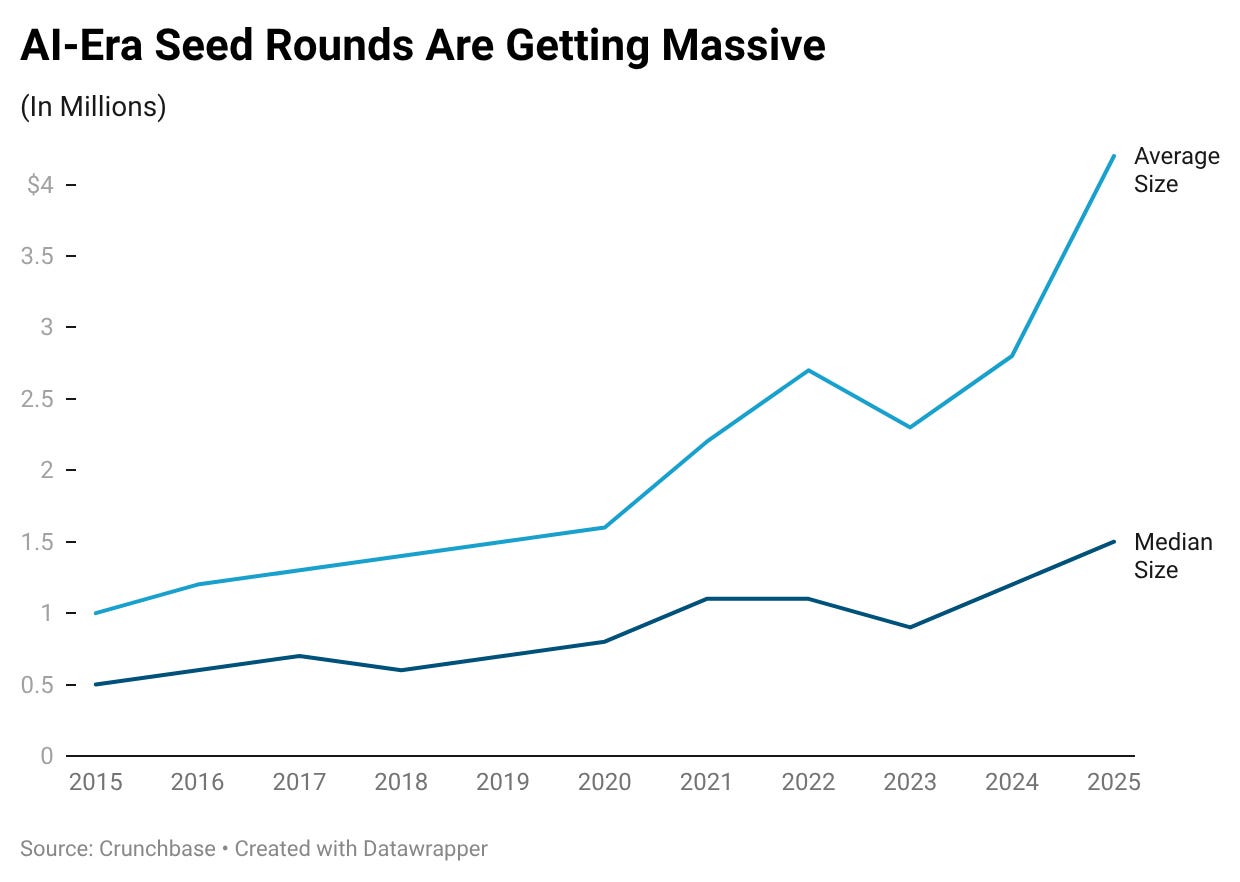

This is all a big shift from the carefully staged financing rounds that have long been standard practice in the Valley, serving both to reduce risk for VCs and lock in incentives for early employees. Seed rounds haven’t always carried a valuation at all, relying instead on convertible notes.

But with AI progressing astonishingly fast, and ferocious competition among hot startups for money and talent, VCs have to play the mega-seed game and commit to a big early-stage valuation with very little data on the company’s progress.

How much is too much?

But even in a market willing to do billion-dollar seeds, some founders are finding reasons to leave money on the table. Former Mosaic ML founder Naveen Rao launched his new startup Unconventional AI with a $1 billion seed round written into the initial term sheet.